Pfizer 2012 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

96

2012 Financial Report

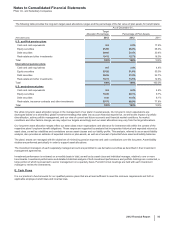

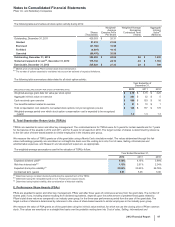

The following table summarizes all RSU activity during 2012:

Shares

(Thousands)

Weighted-

Average

Grant Date

Fair Value

Per Share

Nonvested, December 31, 2011 41,940 $17.08

Granted 13,232 21.05

Vested (15,464) 15.09

Reinvested dividend equivalents 1,585 22.95

Forfeited (3,433) 19.17

Nonvested, December 31, 2012 37,860 $19.34

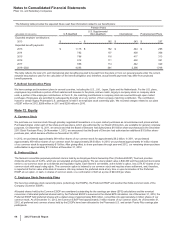

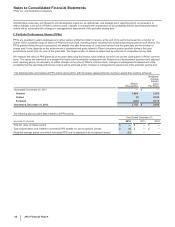

The following table provides data related to all RSU activity:

(MILLIONS OF DOLLARS)

Year Ended December 31,

2012 2011 2010

Total fair value of shares vested $348 $256 $222

Total compensation cost related to nonvested RSU awards not yet recognized, pre-tax $258 $264 $230

Weighted-average period over which RSU cost is expected to be recognized (years) 1.2 1.3 1.4

C. Stock Options

Stock options are awarded to select employees and, when vested, entitle the holder to purchase a specified number of shares of Pfizer

common stock at a price per share equal to the closing market price of Pfizer common stock on the date of grant.

All eligible employees may receive stock option grants. No stock options were awarded to senior and other key management in any period

presented; however, stock options were awarded to certain other employees. In virtually all instances, stock options granted since 2005 vest

after three years of continuous service from the grant date and have a contractual term of 10 years. In most cases, stock options must be held

for at least 1 year from the grant date before any vesting may occur. In the event of a sale or restructuring, options held by employees are

immediately vested and are exercisable for a period from three months to their remaining term, depending on various conditions.

We measure the value of stock option grants as of the grant date using, for virtually all grants, the Black-Scholes-Merton option-pricing model.

The values determined through this fair value methodology generally are amortized on a straight-line basis over the vesting term into Cost of

sales, Selling, informational and administrative expenses, and Research and development expenses, as appropriate.

The following table provides the weighted-average assumptions used in the valuation of stock options:

Year Ended December 31,

2012 2011 2010

Expected dividend yield(a) 4.10%4.14%4.00%

Risk-free interest rate(b) 1.28%2.59%2.87%

Expected stock price volatility(c) 23.78%25.55%26.85%

Expected term(d) (years) 6.50 6.25 6.25

(a) Determined using a constant dividend yield during the expected term of the option.

(b) Determined using the interpolated yield on U.S. Treasury zero-coupon issues.

(c) Determined using implied volatility, after consideration of historical volatility.

(d) Determined using historical exercise and post-vesting termination patterns.