Pfizer 2012 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

63

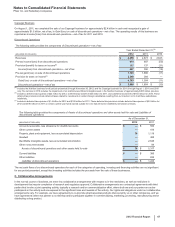

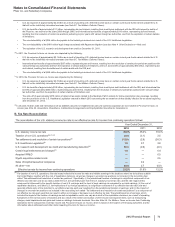

Under the benefit recognition model, if our initial assessment fails to result in the recognition of a tax benefit, we regularly monitor our position

and subsequently recognize the tax benefit: (i) if there are changes in tax law, analogous case law or there is new information that sufficiently

raise the likelihood of prevailing on the technical merits of the position to more-likely-than-not; (ii) if the statute of limitations expires; or (iii) if

there is a completion of an audit resulting in a favorable settlement of that tax year with the appropriate agency. We regularly re-evaluate our

tax positions based on the results of audits of federal, state and foreign income tax filings, statute of limitations expirations, changes in tax law

or receipt of new information that would either increase or decrease the technical merits of a position relative to the more-likely-than-not

standard. Liabilities associated with uncertain tax positions are classified as current only when we expect to pay cash within the next 12

months. Interest and penalties, if any, are recorded in Provision for taxes on income and are classified on our consolidated balance sheet with

the related tax liability.

Amounts recorded for valuation allowances and income tax contingencies can result from a complex series of judgments about future events

and uncertainties and can rely heavily on estimates and assumptions. For information about the risks associated with estimates and

assumptions, see Note 1C. Basis of Presentation and Significant Accounting Policies: Estimates and Assumptions.

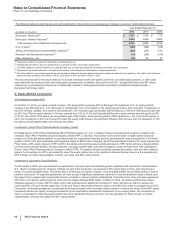

P. Pension and Postretirement Benefit Plans

The majority of our employees worldwide are covered by defined benefit pension plans, defined contribution plans or both. In the U.S., we

have both qualified and supplemental (non-qualified) defined benefit plans, as well as other postretirement benefit plans, consisting primarily

of healthcare and life insurance for retirees. Beginning on January 1, 2011, for employees hired in the U.S. and Puerto Rico after

December 31, 2010, we no longer offer a defined benefit plan and, instead, offer an enhanced benefit under our defined contribution plan. On

May 8, 2012, we announced to employees that as of January 1, 2018, Pfizer will transition its U.S. and Puerto Rico employees from its defined

benefit plans to an enhanced defined contribution savings plan. We recognize the overfunded or underfunded status of each of our defined

benefit plans as an asset or liability on our consolidated balance sheet. The obligations are generally measured at the actuarial present value

of all benefits attributable to employee service rendered, as provided by the applicable benefit formula. Our pension and other postretirement

obligations may include assumptions such as long-term rate of return on plan assets, expected employee turnover and participant mortality.

For our pension plans, the obligation may also include assumptions as to future compensation levels. For our other postretirement benefit

plans, the obligation may include assumptions as to the expected cost of providing the healthcare and life insurance benefits, as well as the

extent to which those costs are shared with the employee or others (such as governmental programs). Plan assets are measured at fair value.

Net periodic benefit costs are recognized, as required, into Cost of sales, Selling, informational and administrative expenses and Research

and development expenses, as appropriate.

Amounts recorded for pension and postretirement benefit plans can result from a complex series of judgments about future events and

uncertainties and can rely heavily on estimates and assumptions. For information about the risks associated with estimates and assumptions,

see Note 1C. Basis of Presentation and Significant Accounting Policies: Estimates and Assumptions.

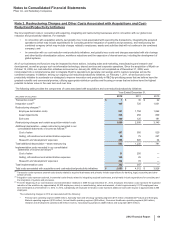

Q. Legal and Environmental Contingencies

We and certain of our subsidiaries are subject to numerous contingencies arising in the ordinary course of business, such as patent litigation,

product liability and other product-related litigation, commercial litigation, environmental claims and proceedings, government investigations

and guarantees and indemnifications. We record accruals for these contingencies to the extent that we conclude that a loss is both probable

and reasonably estimable. If some amount within a range of loss appears to be a better estimate than any other amount within the range, we

accrue that amount. Alternatively, when no amount within a range of loss appears to be a better estimate than any other amount, we accrue

the lowest amount in the range. We record anticipated recoveries under existing insurance contracts when recovery is assured.

Amounts recorded for contingencies can result from a complex series of judgments about future events and uncertainties and can rely heavily

on estimates and assumptions. For information about the risks associated with estimates and assumptions, see Note 1C. Basis of

Presentation and Significant Accounting Policies: Estimates and Assumptions.

R. Share-Based Payments

Our compensation programs can include share-based payments. Generally, grants under share-based payment programs are accounted for

at fair value and these fair values are generally amortized on a straight-line basis over the vesting terms into Cost of sales, Selling,

informational and administrative expenses and Research and development expenses, as appropriate.

Amounts recorded for share-based compensation can result from a complex series of judgments about future events and uncertainties and

can rely heavily on estimates and assumptions. For information about the risks associated with estimates and assumptions, see Note 1C.

Basis of Presentation and Significant Accounting Policies: Estimates and Assumptions.

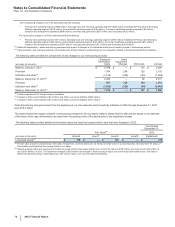

Note 2. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments

A. Acquisitions

NextWave Pharmaceuticals, Inc.

On November 27, 2012, we completed our acquisition of NextWave Pharmaceuticals Incorporated (NextWave), a privately held, specialty

pharmaceutical company. As a result of this acquisition, Pfizer now holds exclusive North American rights to Quillivant XR™ (methylphenidate

hydrochloride), the first once-daily liquid medication approved in the U.S. for the treatment of attention deficit hyperactivity disorder. Quillivant