Pfizer 2012 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

43

The following table provides the current ratings assigned by these rating agencies to Pfizer commercial paper and senior unsecured non-

credit-enhanced long-term debt:

NAME OF RATING AGENCY

Pfizer

Commercial Paper

Pfizer

Long-term Debt Date of Last

ActionRating Rating Outlook

Moody’s P-1 A1 Stable October 2009

S&P A1+ AA Stable October 2009

See "Subsequent Events" above for information about a January 2013 Zoetis debt offering and the Zoetis commercial paper program.

Debt Capacity

We have available lines of credit and revolving credit agreements with a group of banks and other financial intermediaries. We maintain cash

and cash equivalent balances and short-term investments in excess of our commercial paper and other short-term borrowings. As of

December 31, 2012, we had access to $9.1 billion of lines of credit, of which $2.0 billion expire within one year. Of these lines of credit, $8.4

billion are unused, of which our lenders have committed to loan us $7.1 billion at our request. Also, $7.0 billion of our unused lines of credit, all

of which expire in 2016, may be used to support our commercial paper borrowings.

In December 2012, Zoetis entered into a revolving credit agreement providing for a five-year $1.0 billion senior unsecured revolving credit

facility, which became effective in February 2013 and expires in December 2017.

See "Subsequent Events" above for information about a January 2013 Zoetis debt offering and the Zoetis commercial paper program.

Global Economic Conditions

The challenging economic environment has not had, nor do we anticipate it will have, a significant impact on our liquidity. Due to our significant

operating cash flows, financial assets, access to capital markets and available lines of credit and revolving credit agreements, we continue to

believe that we have the ability to meet our liquidity needs for the foreseeable future. As markets change, we continue to monitor our liquidity

position. There can be no assurance that the challenging economic environment or a further economic downturn would not impact our ability

to obtain financing in the future.

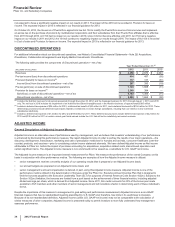

Contractual Obligations

Payments due under contractual obligations as of December 31, 2012, mature as follows:

Years

(MILLIONS OF DOLLARS) Total 2013 2014-2015 2016-2017 Thereafter

Long-term debt, including current portion(a) $33,485 $2,449 $6,987 $6,356 $17,693

Interest payments on long-term debt obligations(b) 17,980 1,494 2,675 2,137 11,674

Other long-term liabilities reflected on our consolidated balance

sheet under U.S. GAAP(c) 5,034 474 899 892 2,769

Lease commitments(d) 1,288 190 304 164 630

Purchase obligations and other(e) 3,534 1,500 1,439 277 318

Uncertain tax positions(f) 80 80 — — —

(a) Long-term debt consists of senior unsecured notes, including fixed and floating rate, foreign currency denominated, and other notes.

(b) Our calculations of expected interest payments incorporate only current period assumptions for interest rates, foreign currency translation rates and hedging

strategies (see Notes to Consolidated Financial Statements—Note 7. Financial Instruments), and assume that interest is accrued through the maturity date or

expiration of the related instrument.

(c) Includes expected payments relating to our unfunded U.S. supplemental (non-qualified) pension plans, postretirement plans and deferred compensation plans.

Excludes amounts relating to our U.S. qualified pension plans and international pension plans, all of which have a substantial amount of plan assets, because

the required funding obligations are not expected to be material and/or because such liabilities do not necessarily reflect future cash payments, as the impact of

changes in economic conditions on the fair value of the pension plan assets and/or liabilities can be significant; however, we currently anticipate contributing

approximately $343 million to these plans in 2013. Also excludes $3.9 billion of liabilities related to the fair value of derivative financial instruments, legal

matters, employee terminations, environmental matters and other, most of which do not represent contractual obligations. See also our liquidity discussion

above in this "Analysis of Financial Condition, Liquidity and Capital Resources" section, as well as the Notes to Consolidated Financial Statements—Note 3.

Restructuring Charges and Other Costs Associated with Acquisitions and Cost-Reduction/Productivity Initiatives, Note 7A. Financial Instruments: Selected

Financial Assets and Liabilities, Note 11E. Pension and Postretirement Benefit Plans and Defined Contribution Plans: Cash Flows, and Note 17. Commitments

and Contingencies.

(d) Includes operating and capital lease obligations.

(e) Includes agreements to purchase goods and services that are enforceable and legally binding and includes amounts relating to advertising, information

technology services, employee benefit administration services, and potential milestone payments deemed reasonably likely to occur.

(f) Includes amounts reflected in Income taxes payable only. We are unable to predict the timing of tax settlements related to our noncurrent obligations for

uncertain tax positions as tax audits can involve complex issues and the resolution of those issues may span multiple years, particularly if subject to negotiation

or litigation.