Pfizer 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

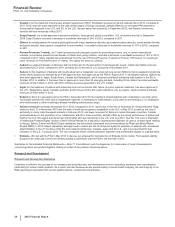

Financial Review

Pfizer Inc. and Subsidiary Companies

22

2012 Financial Report

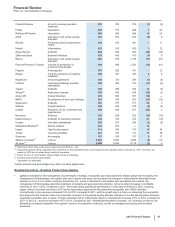

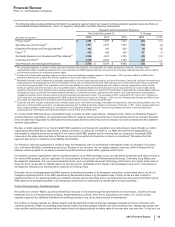

• Lipitor, for the treatment of elevated LDL-cholesterol levels in the blood, recorded worldwide revenues of $3.9 billion, a decrease of 59%,

in 2012, compared to 2011 due to:

the impact of loss of exclusivity in Japan in June 2011 (with generic competition occurring in November 2011), the U.S. (with generic

competition occurring in November 2011 and multi-source generic competition occurring in May 2012), Australia in April 2012 and

most of developed Europe in March 2012 and May 2012;

the continuing impact of an intensely competitive lipid-lowering market with competition from generics and branded products

worldwide; and

increased payer pressure worldwide, including the need for flexible rebate policies.

Geographically,

in the U.S., branded Lipitor revenues were $932 million, a decrease of 81% in 2012, compared to 2011; and

in our international markets, branded Lipitor revenues were $3.0 billion, a decrease of 34% in 2012, compared to 2011. Foreign

exchange had an unfavorable impact on international revenues of $70 million in 2012, compared to 2011.

See the “Our Operating Environment” section of this Financial Review for a discussion concerning losses of exclusivity for Lipitor in

various markets.

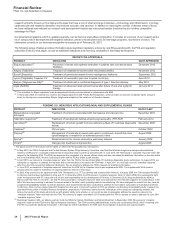

• Enbrel, for the treatment of moderate-to-severe rheumatoid arthritis, polyarticular juvenile rheumatoid arthritis, psoriatic arthritis, plaque

psoriasis and ankylosing spondylitis, a type of arthritis affecting the spine, recorded increases in worldwide revenues, excluding the U.S.

and Canada, of 2% in 2012, compared to 2011, primarily due to the overall growth in the anti-tumor necrosis factor (TNF) biologic market,

partially offset by the unfavorable impact of foreign exchange.

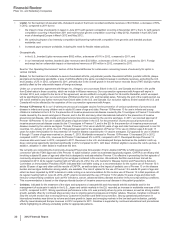

Under our co-promotion agreement with Amgen Inc. (Amgen), we co-promote Enbrel in the U.S. and Canada and share in the profits

from Enbrel sales in those countries, which we include in Alliance revenues. Our co-promotion agreement with Amgen will expire in

October 2013, and, subject to the terms of the agreement, we are entitled to a royalty stream for 36 months thereafter, which we expect

will be significantly less than our current share of Enbrel profits from U.S. and Canadian sales. Following the end of the royalty period, we

will not be entitled to any further revenues from Enbrel sales in the U.S. and Canada. Our exclusive rights to Enbrel outside the U.S. and

Canada will not be affected by the expiration of the co-promotion agreement with Amgen.

•Prevnar 13/Prevenar 13 is our 13-valent pneumococcal conjugate vaccine for the prevention of various syndromes of pneumococcal

disease in infants and young children and in adults 50 years of age and older. Prevnar 13/Prevenar 13 for use in infants and young

children is marketed in the U.S. for the prevention of invasive pneumococcal disease caused by the 13 serotypes in Prevnar 13 and otitis

media caused by the seven serotypes in Prevnar, and in the EU and many other international markets for the prevention of invasive

pneumococcal disease, otitis media and pneumococcal pneumonia caused by the vaccine serotypes. In 2011, we received approval of

Prevnar 13/Prevenar 13 for use in adults 50 years of age and older in the U.S. for the prevention of pneumococcal pneumonia and

invasive pneumococcal disease caused by the 13 serotypes in Prevnar 13, and in the EU for the prevention of invasive pneumococcal

disease caused by the vaccine serotypes. To date, Prevenar 13 for use in adults 50 years of age and older has been approved in over 55

countries. On January 25, 2013, the U.S. FDA granted approval for the expansion of Prevnar 13 for use in children ages 6 through 17

years for active immunization for the prevention of invasive disease caused by the 13 vaccine serotypes. EU approval for use in children

6 through 17 years of age was received on January 7, 2013. Worldwide revenues for Prevnar 13/Prevenar 13 increased 2% in 2012,

compared to 2011. In the U.S., revenues for Prevnar 13 decreased 2% in 2012, compared to 2011. Developed Europe Prevenar 13

revenues also were lower in 2012, compared to 2011. Revenues in the U.S. and developed Europe declined as the pediatric catch-up

dose commercial opportunity declined significantly in 2012 compared to 2011, with fewer children eligible to receive the catch-up dose. In

addition, utilization in older adults is modest at this time.

We currently are conducting the Community-Acquired Pneumonia Immunization Trial in Adults (CAPiTA) to fulfill requirements in

connection with the FDA’s approval of the Prevnar 13 adult indication under its accelerated approval program. CAPiTA is an efficacy trial

involving subjects 65 years of age and older that is designed to evaluate whether Prevnar 13 is effective in preventing the first episode of

community-acquired pneumonia caused by the serotypes contained in the vaccine. We estimate that this event-driven trial will be

completed in 2013. At its regular meeting held on February 22, 2012, the U.S. Centers for Disease Control and Prevention’s Advisory

Committee on Immunization Practices (ACIP) indicated that it will defer voting on a recommendation for the routine use of Prevnar 13 in

adults 50 years of age and older until the results of CAPiTA, as well as data on the impact of pediatric use of Prevnar 13 on the disease

burden and serotype distribution among adults, are available. The rate of uptake for the use of Prevnar 13 in adults 50 years of age and

older has been impacted by ACIP’s decision to defer voting on a recommendation for the routine use of Prevnar 13 in that population. At

its regular meeting held on June 20, 2012, ACIP voted to recommend the use of Prevnar 13 for adults 19 years of age and older with

immuno-compromising conditions such as HIV infections, cancer, advanced kidney disease and other immuno-compromising conditions.

This recommendation is based on the disproportionate burden of invasive pneumococcal disease in this patient population.

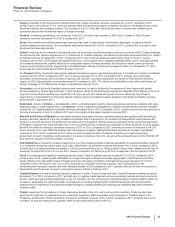

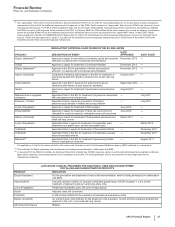

•Celebrex, indicated for the treatment of the signs and symptoms of osteoarthritis and rheumatoid arthritis worldwide and for the

management of acute pain in adults in the U.S., Japan and certain markets in the EU, recorded an increase in worldwide revenues of 8%

in 2012, compared to 2011. Strong operational performance in the U.S. was primarily driven by price increases, as well as strong market

growth, partially offset by continued share erosion due to ongoing generic pressures and higher rebates. However, Celebrex continued to

slow the volume erosion due to strong Direct to Customer investment and field force promotion. Strong operational performance in

international markets was driven by volume and share growth in Japan and emerging markets in the low back pain indication, partially

offset by lower developed Europe revenues in 2012 compared to 2011. Celebrex is supported by continued educational and promotional

efforts highlighting its efficacy and safety profile for appropriate patients.