Pfizer 2012 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

2

2012 Financial Report

OVERVIEW OF OUR PERFORMANCE, OPERATING ENVIRONMENT, STRATEGY AND OUTLOOK

Our Business

Our mission is to apply science and our global resources to improve health and well-being at every stage of life. We strive to set the standard

for quality, safety and value in the discovery, development and manufacturing of medicines for people and animals. Our diversified global

healthcare portfolio includes human and animal biologic and small molecule medicines and vaccines, as well as many of the world’s best-

known consumer products. Every day, we work across developed and emerging markets to advance wellness, prevention, treatments and

cures that challenge the most feared diseases of our time. We also collaborate with healthcare providers, governments and local communities

to support and expand access to reliable, affordable healthcare around the world. Our revenues are derived from the sale of our products, as

well as through alliance agreements, under which we co-promote products discovered by other companies (Alliance revenues).

The majority of our revenues come from the manufacture and sale of biopharmaceutical products. The biopharmaceutical industry is highly

competitive and we face a number of industry-specific challenges, which can significantly impact our results. These factors include, among

others: the loss or expiration of intellectual property rights, the regulatory environment and pipeline productivity, pricing and access pressures,

and increasing competition among branded products. (For more information about these challenges, see the “Our Operating Environment”

section of this Financial Review.)

The financial information included in our consolidated financial statements for our subsidiaries operating outside the United States (U.S.) is as

of and for the year ended November 30 for each year presented.

References to developed markets include the U.S., Western Europe, Japan, Canada, Australia, Scandinavia, South Korea, Finland and New

Zealand; and references to Emerging Markets include the rest of the world, including, among other countries, China, Brazil, Mexico, Turkey,

Russia and India.

On February 6, 2013, an initial public offering (IPO) of our subsidiary, Zoetis Inc. (Zoetis), was completed, pursuant to which we sold 99.015

million shares of Zoetis in exchange for the retirement of approximately $2.5 billion of Pfizer commercial paper issued on January 10, 2013.

The IPO represented approximately 19.8% of the total outstanding Zoetis shares. On February 1, 2013, Zoetis shares began trading on the

New York Stock Exchange under the symbol "ZTS." Prior to and in connection with the IPO, Zoetis completed a $3.65 billion senior notes

offering and we transferred to Zoetis substantially all of the assets and liabilities of our Animal Health business. (For additional information, see

Notes to Consolidated Financial Statements––Note 19A. Subsequent Events: Zoetis Debt Offering and Initial Public Offering.)

On November 30, 2012, we completed the sale of our Nutrition business to Nestlé for $11.85 billion in cash and recognized a gain of

approximately $4.8 billion, net of tax, in Gain/(loss) on sale of discontinued operations––net of tax. The operating results of this business are

reported as Income/(loss) from discontinued operations––net of tax in our consolidated statements of income for all periods presented. In

addition, in our consolidated balance sheet as of December 31, 2011, the assets and liabilities associated with this discontinued operation are

classified as Assets of discontinued operations and other assets held for sale and Liabilities of discontinued operations, as appropriate. (For

additional information, see Notes to Consolidated Financial Statements––Note 2B. Acquisitions, Divestitures, Collaborative Arrangements and

Equity-Method Investments: Divestitures and see the “Our Business Development Initiatives” and “Discontinued Operations” sections of this

Financial Review.)

On August 1, 2011, we completed the sale of our Capsugel business for approximately $2.4 billion in cash and recognized a gain of

approximately $1.3 billion, net of tax, in Gain/(loss) on sale of discontinued operations––net of tax. The operating results of this business are

reported as Income/(loss) from discontinued operations––net of tax in our consolidated statements of income for the years ended December

31, 2011 and December 31, 2010. (For additional information, see Notes to Consolidated Financial Statements––Note 2B. Acquisitions,

Divestitures, Collaborative Arrangements and Equity-Method Investments: Divestitures and see the “Our Business Development Initiatives”

and “Discontinued Operations” sections of this Financial Review.)

The assets, liabilities, operating results and cash flows of acquired businesses, such as King Pharmaceuticals, Inc. (King) (acquired on

January 31, 2011), are included in our results on a prospective basis only commencing from the acquisition date. As such, our consolidated

financial statements for the year ended December 31, 2011 reflect approximately 11 months of King’s U.S. operations and approximately 10

months of King’s international operations. (For additional information about these acquisitions, see Notes to Consolidated Financial

Statements––Note 2A. Acquisitions, Divestitures, Collaborative Arrangements and Equity-Method Investments: Acquisitions and see the “Our

Business Development Initiatives” section of this Financial Review.)

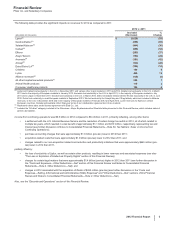

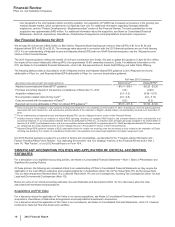

Our 2012 Performance

Revenues decreased 10% in 2012 to $59.0 billion, compared to $65.3 billion in 2011, which reflects an operational decline of $4.8 billion or

8%, primarily the result of the loss of exclusivity of Lipitor in most major markets, including the U.S. on November 30, 2011 and most of

developed Europe in March and May 2012, and the unfavorable impact of foreign exchange of $1.5 billion, or 2%. Lipitor and other product

losses of exclusivity, as well as the final-year terms of our collaboration agreements in certain markets for Spiriva, negatively impacted

revenues by approximately $7.7 billion, or 12%, in 2012 compared to 2011.