Pfizer 2012 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial Review

Pfizer Inc. and Subsidiary Companies

12

2012 Financial Report

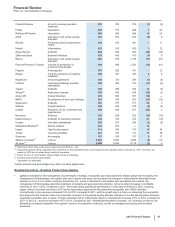

findings, updated commercial forecasts, changes in pricing, an increased competitive environment, litigation uncertainties regarding

intellectual property and declining gross margins. The impairment charges in 2012 are associated with the following: Worldwide Research

and Development ($303 million); Consumer Healthcare ($200 million); Primary Care ($135 million); Established Products ($83 million);

Specialty Care ($56 million); Emerging Markets ($56 million) and Animal Health ($39 million).

• In 2011, $851 million, the majority of which relates to intangible assets that were acquired as part of our acquisition of Wyeth. These

impairment charges reflect (i) $475 million of IPR&D assets, primarily related to two compounds for the treatment of certain autoimmune

and inflammatory diseases; (ii) $193 million related to our biopharmaceutical indefinite-lived brand, Xanax; and (iii) $183 million related to

Developed Technology Rights comprising the impairment of five assets. The intangible asset impairment charges for 2011 reflect, among

other things, the impact of new scientific findings and an increased competitive environment. The impairment charges in 2011 are

associated with the following: Worldwide Research and Development ($394 million); Established Products ($193 million); Specialty Care

($135 million); Primary Care ($56 million); Oncology ($56 million) and Animal Health ($17 million).

• In 2010, $1.8 billion, the majority of which relates to intangible assets that were acquired as part of our acquisition of Wyeth. These

impairment charges reflect (i) $945 million of IPR&D assets, primarily Prevnar 13/Prevenar 13 Adult, a compound for the prevention of

pneumococcal disease in adults age 50 and older, and Neratinib, a compound for the treatment of breast cancer; (ii) $292 million of

indefinite-lived Brands, primarily related to Robitussin, a cough suppressant; and (iii) $540 million of Developed Technology Rights,

primarily Thelin, a product that treated pulmonary hypertension, and Protonix, a product that treats erosive gastroesophageal reflux

disease. These impairment charges, most of which occurred in the third quarter of 2010, reflect, among other things, the following: for

IPR&D assets, the impact of changes to the development programs, the projected development and regulatory time-frames and the risk

associated with these assets; for Brand assets, the current competitive environment and planned investment support; and, for Developed

Technology Rights, in the case of Thelin, we voluntarily withdrew the product in regions where it was approved and discontinued all

clinical studies worldwide, and for the others, an increased competitive environment. The impairment charges in 2010 are generally

associated with the following: Specialty Care ($708 million); Oncology ($396 million); Consumer Healthcare ($292 million); Established

Products ($182 million); Primary Care ($145 million); and Worldwide Research and Development ($54 million).

For a description of our accounting policy, see Notes to Consolidated Financial Statements––Note 1K. Basis of Presentation and Significant

Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

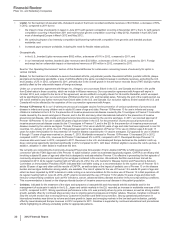

When we are required to determine the fair value of intangible assets other than goodwill, we use an income approach, specifically the multi-

period excess earnings method, also known as the discounted cash flow method. We start with a forecast of all the expected net cash flows

associated with the asset, which includes the application of a terminal value for indefinite-lived assets, and then we apply an asset-specific

discount rate to arrive at a net present value amount. Some of the more significant estimates and assumptions inherent in this approach

include: the amount and timing of the projected net cash flows, which includes the expected impact of competitive, legal and/or regulatory

forces on the projections and the impact of technological risk associated with in-process research and development assets, as well as the

selection of a long-term growth rate; the discount rate, which seeks to reflect the various risks inherent in the projected cash flows; and the tax

rate, which seeks to incorporate the geographic diversity of the projected cash flows.

While all intangible assets other than goodwill can confront events and circumstances that can lead to impairment, in general, intangible

assets other than goodwill that are most at risk of impairment include in-process research and development assets (approximately $700

million as of December 31, 2012) and newly acquired or recently impaired indefinite-lived brand assets (approximately $2.3 billion as of

December 31, 2012). In-process research and development assets are high-risk assets, as research and development is an inherently risky

activity. Newly acquired and recently impaired indefinite-lived assets are more vulnerable to impairment as the assets are recorded at fair

value and are then subsequently measured at the lower of fair value or carrying value at the end of each reporting period. As such,

immediately after acquisition or impairment, even small declines in the outlook for these assets can negatively impact our ability to recover the

carrying value and can result in an impairment charge.

• Some of our indefinite-lived Consumer Healthcare brands, mainly Robitussin and Chapstick, have fair values that approximate their

combined carrying value of about $900 million, which reflects impairment charges that were taken in the fourth quarter and first quarter of

2012. These assets continue to be at risk for future impairment. Any negative change in the undiscounted cash flows, discount rate and/

or tax rate could result in an impairment charge. We re-considered and confirmed the classification of these assets as indefinite-lived. We

will continue to closely monitor these assets.

• One of our indefinite-lived biopharmaceutical brands, Xanax, was written down to its fair value of $1.2 billion at the end of 2011. This

asset continues to be at risk for future impairment. Any negative change in the undiscounted cash flows, discount rate and/or tax rate

could result in an impairment charge. Xanax, which was launched in the mid-1980’s and acquired in 2003, must continue to remain

competitive against its generic challengers or the associated asset may become impaired again. We re-considered and confirmed the

classification of this asset as indefinite-lived. We will continue to closely monitor this asset.

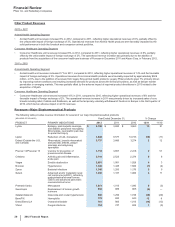

Goodwill

As a result of our goodwill impairment review work, we concluded that none of our goodwill is impaired as of December 31, 2012, and we do

not believe the risk of impairment is significant at this time.

For a description of our accounting policy, see Notes to Consolidated Financial Statements—Note 1K. Basis of Presentation and Significant

Accounting Policies: Amortization of Intangible Assets, Depreciation and Certain Long-Lived Assets.

When we are required to determine the fair value of a reporting unit, as appropriate for the individual reporting unit, we may use the market

approach, the income approach or a weighted-average combination of both approaches.