Pfizer 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Pfizer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated Financial Statements

Pfizer Inc. and Subsidiary Companies

2012 Financial Report

67

Capsugel Business

On August 1, 2011, we completed the sale of our Capsugel business for approximately $2.4 billion in cash and recognized a gain of

approximately $1.3 billion, net of tax, in Gain/(loss) on sale of discontinued operations––net of tax. The operating results of this business are

reported as Income/(loss) from discontinued operations––net of tax for 2011 and 2010.

Discontinued Operations

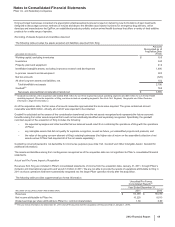

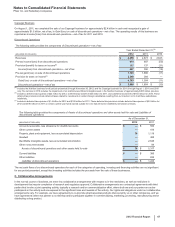

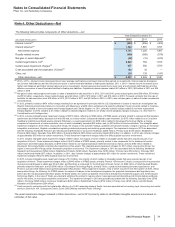

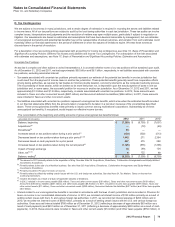

The following table provides the components of Discontinued operations—net of tax:

Year Ended December 31,(a)

(MILLIONS OF DOLLARS) 2012 2011 2010

Revenues $2,258 $2,673 $2,643

Pre-tax income/(loss) from discontinued operations 414 487 (50)

Provision/(benefit) for taxes on income(b) 117 137 (31)

Income/(loss) from discontinued operations––net of tax 297 350 (19)

Pre-tax gain/(loss) on sale of discontinued operations 7,123 1,688 (11)

Provision for taxes on income(c) 2,340 384 —

Gain/(loss) on sale of discontinued operations––net of tax 4,783 1,304 (11)

Discontinued operations––net of tax $5,080 $1,654 $(30)

(a) Includes the Nutrition business for all periods presented (through November 30, 2012) and the Capsugel business for 2011 (through August 1, 2011) and 2010

only. The net loss in 2010 includes the impairment of an indefinite-lived Brand intangible asset in the Nutrition business of approximately $385 million (pre-tax).

(b) Includes a deferred tax expense of $24 million for 2012, a deferred tax benefit of $43 million for 2011, and a deferred tax benefit of $156 million for 2010. These

deferred tax provisions include deferred taxes related to investments in certain foreign subsidiaries resulting from our intention not to hold these subsidiaries

indefinitely.

(c) Includes a deferred tax expense of $1.4 billion for 2012 and $190 million for 2011. These deferred tax provisions include deferred tax expense of $2.2 billion for

2012 and $190 million for 2011 on certain current-year funds earned outside the U.S. that will not be indefinitely reinvested overseas.

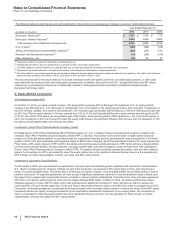

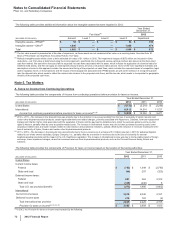

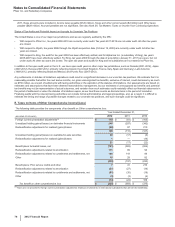

The following table provides the components of Assets of discontinued operations and other assets held for sale and Liabilities of

discontinued operations:

As of December 31,

(MILLIONS OF DOLLARS) 2012 2011

Accounts receivable, less allowance for doubtful accounts $—$550

Other current assets —419

Property, plant and equipment, less accumulated depreciation 70 1,118

Goodwill —498

Identifiable intangible assets, less accumulated amortization —2,648

Other noncurrent assets —84

Assets of discontinued operations and other assets held for sale $70$5,317

Current liabilities $—$385

Other liabilities —839

Liabilities of discontinued operations $—$1,224

The net cash flows of our discontinued operations for each of the categories of operating, investing and financing activities are not significant

for any period presented, except that investing activities includes the proceeds from the sale of these businesses.

C. Collaborative Arrangements

In the normal course of business, we enter into collaborative arrangements with respect to in-line medicines, as well as medicines in

development that require completion of research and regulatory approval. Collaborative arrangements are contractual agreements with third

parties that involve a joint operating activity, typically a research and/or commercialization effort, where both we and our partner are active

participants in the activity and are exposed to the significant risks and rewards of the activity. Our rights and obligations under our collaborative

arrangements vary. For example, we have agreements to co-promote pharmaceutical products discovered by us or other companies, and we

have agreements where we partner to co-develop and/or participate together in commercializing, marketing, promoting, manufacturing and/or

distributing a drug product.