Panera Bread 2007 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

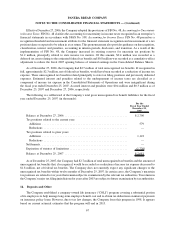

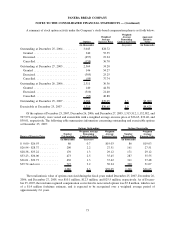

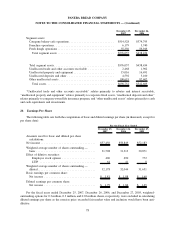

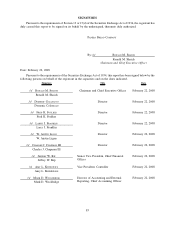

A summary of stock option activity under the Company’s stock-based compensation plans is set forth below:

Options

Weighted

Average

Exercise Price

Weighted

Average

Remaining

Contractual Term

Aggregate

Intrinsic

Value

(in thousands) (in years) (in thousands)

Outstanding at December 25, 2004 . ........ 3,045 $28.72

Granted ........................... 340 55.55

Exercised .......................... (657) 19.24

Cancelled.......................... (159) 36.70

Outstanding at December 27, 2005 . ........ 2,569 34.20

Granted ........................... 146 54.27

Exercised .......................... (305) 25.25

Cancelled.......................... (99) 37.74

Outstanding at December 26, 2006 . ........ 2,311 36.36

Granted ........................... 140 44.58

Exercised .......................... (310) 21.40

Cancelled.......................... (55) 40.88

Outstanding at December 25, 2007 . ........ 2,086 $39.05 2.3 $5,000

Exercisable at December 25, 2007 . ........ 1,316 $36.65 1.9 $4,425

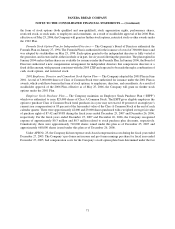

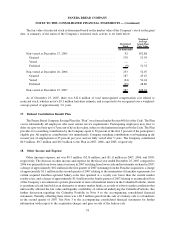

Of the options at December 25, 2007, December 26, 2006, and December 27, 2005, 1,315,512, 1,152,382, and

927,972, respectively, were vested and exercisable with a weighted average exercise price of $36.65, $32.40, and

$30.01, respectively. The following table summarizes information concerning outstanding and exercisable options

at December 25, 2007:

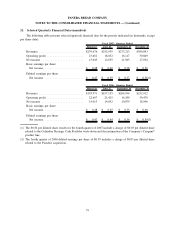

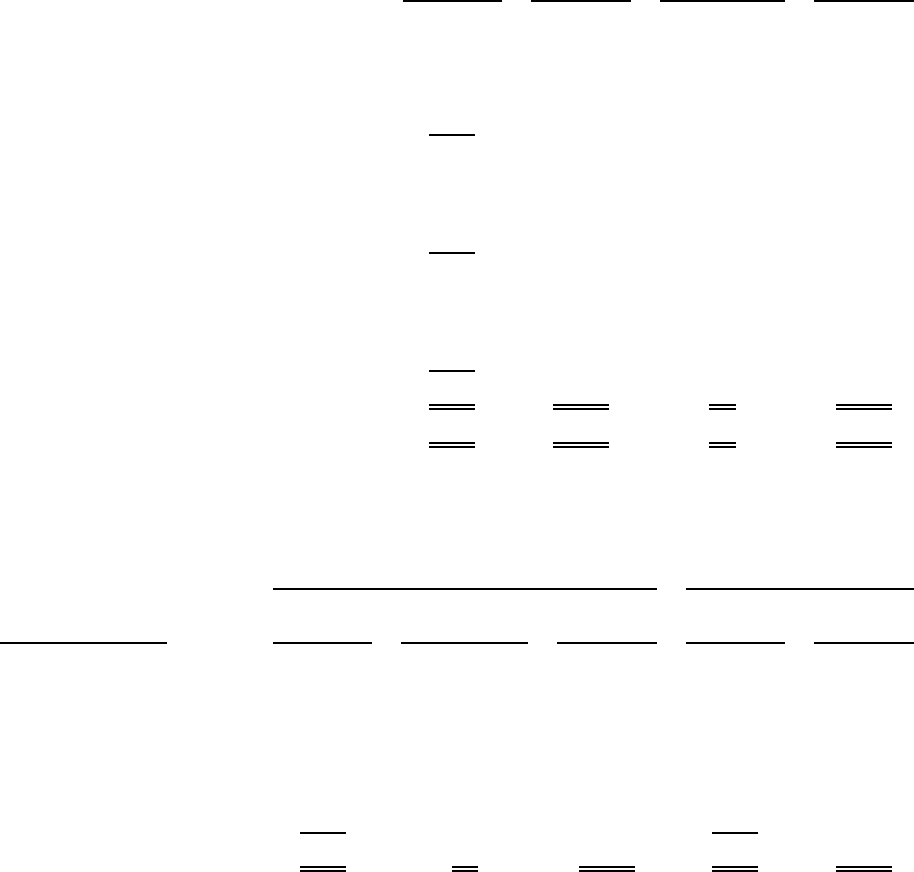

Range of Exercise Price

Number

Outstanding

Weighted Average

Remaining

Contractual Life

Weighted

Average

Exercise Price

Number

Exercisable

Weighted

Average

Exercise Price

Options Outstanding Options Exercisable

(in thousands) (in years) (in thousands)

$ 0.00 - $26.93 ........... 86 0.7 $19.03 86 $19.03

$26.94 - $28.37 ........... 200 2.2 27.51 161 27.51

$28.38 - $33.22 ........... 170 1.3 29.12 171 29.12

$33.23 - $36.00 ........... 473 2.5 35.45 287 35.55

$36.01 - $39.73 ........... 430 1.3 37.42 311 37.48

$39.74 and over ........... 727 3.2 50.24 300 51.07

2,086 2.3 $39.05 1,316 $36.65

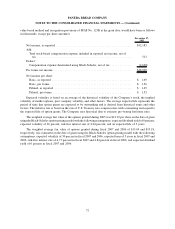

The total intrinsic value of options exercised during the fiscal years ended December 25, 2007, December 26,

2006, and December 27, 2005, was $10.1 million, $12.3 million, and $25.5 million, respectively. As of Decem-

ber 25, 2007, the total unrecognized compensation cost related to non-vested options was $7.8 million, which is net

of a $1.4 million forfeiture estimate, and is expected to be recognized over a weighted average period of

approximately 2.6 years.

73

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)