Panera Bread 2007 Annual Report Download - page 79

Download and view the complete annual report

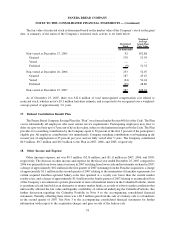

Please find page 79 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Treasury Stock

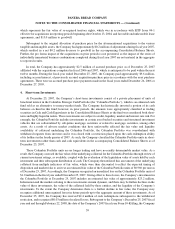

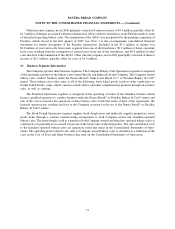

Pursuant to the terms of the 2005 Long-Term Incentive Program (“2005 LTIP”) and the applicable award

agreements, the Company repurchased 6,594 shares of Class A common stock at an average cost of $43.62 per share

during fiscal year 2007, as surrendered by the 2005 LTIP participants. In the third quarter of 2000, the Company

repurchased 109,000 shares of Class A common stock at an average cost of $8.25 per share. The shares surrendered

to the Company by 2005 LTIP participants during the third and fourth quarters of fiscal 2007 and repurchased by the

Company in the third quarter of 2000 are currently held by the Company as treasury stock.

Share Repurchase Program

During fiscal year 2007, the Company purchased shares of Class A common stock under an authorized share

repurchase program. Repurchased shares were retired immediately and resumed the status of authorized but

unissued shares. See Note 11 for further information with respect to the Company’s share repurchase program.

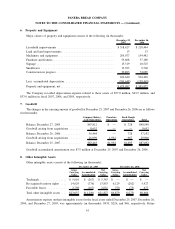

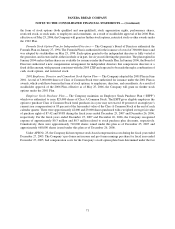

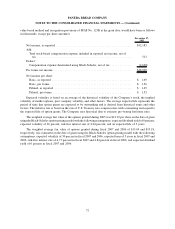

16. Stock-Based Compensation

Effective December 28, 2005, the Company adopted the fair value recognition provisions of SFAS No. 123R,

Accounting for Stock Based Compensation, which requires all stock-based compensation, including grants of

employee stock options, to be recognized in the statement of operations based on their fair values. The Company

adopted this accounting treatment using the modified prospective transition method, as permitted under

SFAS No. 123R; therefore results for prior periods have not been restated. The Company uses the Black-Scholes

option pricing model which requires extensive use of accounting judgment and financial estimates, including

estimates of the expected term participants will retain their vested stock options before exercising them, the

estimated volatility of the Company’s common stock price over the expected term, and the number of options that

will be forfeited prior to the completion of their vesting requirements. The provisions of SFAS No. 123R apply to

new stock options and stock options outstanding, but not yet vested, on the date the Company adopted

SFAS No. 123R.

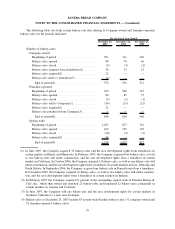

Stock-based compensation expense in fiscal year 2007 related to stock options was $3.9 million, or $0.12 per

diluted share, which is net of $0.6 million of capitalized compensation cost related to new bakery-cafe construction.

The income tax benefit recognized for stock option expense in fiscal year 2007 was $1.4 million. Stock-based

compensation expense in fiscal year 2006 related to stock options was $5.9 million, or $0.18 per diluted share,

which is net of $0.7 million of capitalized compensation cost related to new bakery-cafe construction. The income

tax benefit recognized for stock option expense in fiscal year 2006 was $2.2 million. Cash received from the

exercise of stock options in fiscal 2007 and 2006 was $6.6 million and $7.7 million, respectively. Windfall tax

benefits realized from exercised stock options in fiscal 2007 and 2006 were $3.7 million and $4.3 million,

respectively. SFAS No. 123R also requires that the cash retained as a result of the tax deductibility of increases in the

value of share-based payments be presented as a cash inflow from financing activity in the Consolidated Statements

of Cash Flows, whereas, prior to the adoption, these amounts were presented as an operating activity.

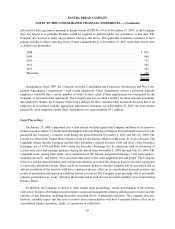

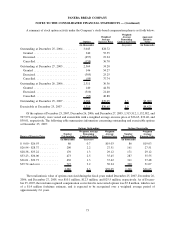

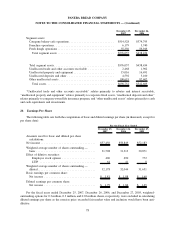

As of December 25, 2007, the Company had one active stock-based compensation plan, the 2006 Stock

Incentive Plan (“2006 Plan”), and had options and restricted stock outstanding (but can make no future grants) under

three other stock-based compensation plans, the 1992 Equity Incentive Plan (“1992 Plan”), the Formula Stock

Option Plan for Independent Directors (“Formula Plan”) and the 2001 Employee, Director, and Consultant Stock

Option Plan (“2001 Plan”).

2006 Stock Incentive Plan — In March 2006, the Company’s Board of Directors adopted the 2006 Plan, which

was approved by the Company’s stockholders in May 2006. The 2006 Plan provides for the grant of up to

1,500,000 shares of the Company’s Class A Common Stock (subject to adjustment in the event of stock splits or

other similar events) as incentive stock options, non-statutory stock options, restricted stock, restricted stock units

and other stock-based awards. As a result of stockholder approval of the 2006 Plan, effective as of May 25, 2006, the

69

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)