Panera Bread 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Historically, our principal requirements for cash have primarily resulted from our capital expenditures for the

development of new Company-owned bakery-cafes, for maintaining or remodeling existing Company-owned

bakery-cafes, for purchasing existing franchise-operated bakery-cafes, for developing, remodeling and maintaining

fresh dough facilities, and for other capital needs such as enhancements to information systems and other

infrastructure. In fiscal 2007, we also used our capital resources to repurchase shares of our common stock

and to purchase a 51 percent ownership interest in Paradise Bakery & Café on February 1, 2007. See Note 3 to the

accompanying consolidated financial statements for information relating to the Paradise acquisition and the

acquisitions of franchise-operated bakery-cafes on February 28, 2007 and June 21, 2007. See Notes 10 and 11 to the

accompanying consolidated financial statements for further information on our credit facility and our share

repurchase program, respectively.

We had net working capital of $24.4 million at December 25, 2007 and $18.0 million at December 26, 2006.

The increase in working capital from December 26, 2006 to December 25, 2007 resulted primarily from an increase

in cash and cash equivalents of $16.1 million, an increase in trade and other accounts receivable of $5.9 million, and

an increase in deferred income taxes of $3.4 million, partially offset by an increase in accrued expenses of

$17.3 million.

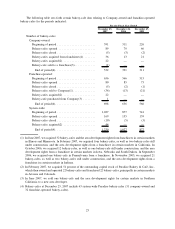

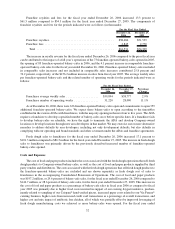

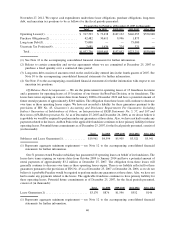

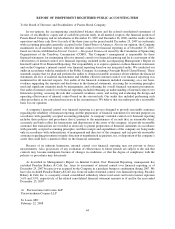

A summary of our cash flows, for the periods indicated, is as follows (in thousands):

Cash provided by (used in):

December 25,

2007

December 26,

2006

December 27,

2005

For the Fiscal Year Ended

Operating activities ............................ $154,014 $104,895 $ 110,628

Investing activities ............................. $(197,262) $ (90,917) $(129,640)

Financing activities ............................ $ 59,393 $ 13,668 $ 13,824

Operating Activities

Funds provided by operating activities for the fiscal year ended December 25, 2007 primarily resulted from net

income, depreciation and amortization, a decrease in prepaid expenses and deferred rent and non-acquisition

accrued expenses, partially offset by an increase in trade and other receivables and deferred income taxes. Funds

provided by operating activities for the fiscal year ended December 26, 2006 primarily resulted from net income,

depreciation and amortization, stock based compensation expense and a decrease in non-acquisition accrued

expenses, partially offset by an increase in prepaid expenses. Funds provided by operating activities for the fiscal

year ended December 27, 2005 primarily resulted from net income, depreciation and amortization, the tax benefit

from exercise of stock options and a decrease in non-acquisition accrued expenses, partially offset by an increase in

trade and other receivables.

Investing Activities

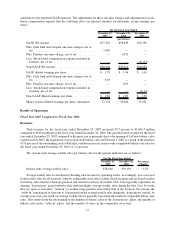

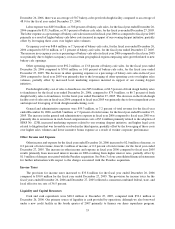

Capital expenditures are the largest ongoing component of our investing activities and include expenditures for

new bakery-cafes and fresh dough facilities, improvements to existing bakery-cafes and fresh dough facilities, and

other capital needs. A summary of capital expenditures for the periods indicated consisted of the following:

December 25,

2007

December 26,

2006

December 27,

2005

For the Fiscal Year Ended

(in thousands)

New bakery-cafe and fresh dough facilities .......... $ 92,864 $ 78,652 $61,804

Bakery-cafe and fresh dough facility improvements .... 27,617 25,775 15,854

Other capital needs ............................ 3,652 4,869 4,398

Total ..................................... $124,133 $109,296 $82,056

Our capital requirements, including development costs related to the opening or acquisition of additional

bakery-cafes and fresh dough facilities and maintenance and remodel expenditures, have and will continue to be

significant. Our future capital requirements and the adequacy of available funds will depend on many factors,

34