Panera Bread 2007 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

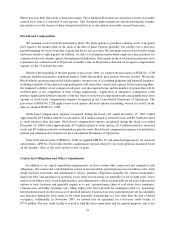

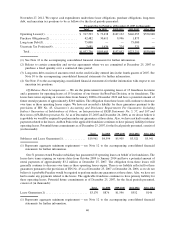

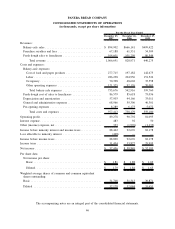

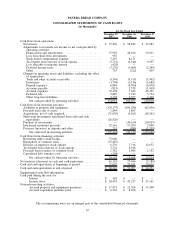

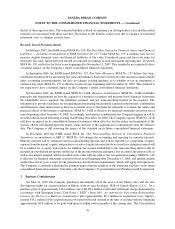

PANERA BREAD COMPANY

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(in thousands)

Shares Amount Shares Amount Shares Amount

December 25, 2007 December 26, 2006 December 27, 2005

For the Fiscal Year Ended

Class A common stock, $.0001 par value:

Balance, beginning of year . . . . . . . . . . . . . . . . . . 30,344 $ 3 29,848 $ 3 29,021 $ 3

Exercise of employee stock options . . . . . . . . . . . . 310 — 305 — 657 —

Issuance of common stock . . . . . . . . . . . . . . . . . . 42 — 29 — 27 —

Conversion of Class B to Class A . . . . . . . . . . . . . 2 — 1 — 51 —

Issuance of restricted stock (net of forfeitures) . . . . . 160 — 161 — 92 —

Acquisition of treasury stock . . . . . . . . . . . . . . . . . (7) — — — — —

Repurchase and retirement of common stock . . . . . . (753) — — — — —

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . 30,098 $ 3 30,344 $ 3 29,848 $ 3

Class B common stock, $.0001 par value:

Balance, beginning of year . . . . . . . . . . . . . . . . . . 1,400 $ — 1,401 $ — 1,452 $ —

Conversion of Class B to Class A . . . . . . . . . . . . . (2) — (1) — (51) —

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . 1,398 $ — 1,400 $ — 1,401 $ —

Treasury stock, at cost:

Balance, beginning of year . . . . . . . . . . . . . . . . . . 109 $ (900) 109 $ (900) 109 $ (900)

Acquisition of treasury stock . . . . . . . . . . . . . . . . . 7 (288) — — — —

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . 116 $ (1,188) 109 $ (900) 109 $ (900)

Additional paid-in capital:

Balance, beginning of year . . . . . . . . . . . . . . . . . . $176,241 $154,402 $130,970

Exercise of employee stock options . . . . . . . . . . . . 6,576 7,716 12,632

Issuance of common stock . . . . . . . . . . . . . . . . . . 1,782 1,606 1,192

Stock compensation . . . . . . . . . . . . . . . . . . . . . . . 7,255 8,171 301

Income tax benefit related to stock option plan . . . . 3,731 4,346 9,307

Repurchase and retirement of common stock . . . . . . (27,199) — —

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . $168,386 $176,241 $154,402

Retained earnings:

Balance, beginning of year . . . . . . . . . . . . . . . . . . $222,322 $163,473 $111,290

Cumulative effect of adjustment resulting from

adoption of FIN No. 48, net of tax (Note 2) . . . . . (815) — —

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 57,456 58,849 52,183

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . $278,963 $222,322 $163,473

Total stockholders’ equity . . . . . . . . . . . . . . . . . . . . . $446,164 $397,666 $316,978

The accompanying notes are an integral part of the consolidated financial statements.

48