Panera Bread 2007 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our investments of certain cash balances in short-term investments are subject to risks which may cause

losses and affect the liquidity of these investments.

At December 25, 2007, our short-term investments consist of a private placement of units of beneficial interest

in the Columbia Strategic Cash Portfolio, or the Columbia Portfolio, which is an enhanced cash fund sold as an

alternative to traditional money-market funds. We have historically invested a portion of our on hand cash balances

in this fund. These investments are subject to credit, liquidity, market and interest rate risk. For example, the

Columbia Portfolio includes investments in certain asset backed securities and structured investment vehicles that

are collateralized by sub-prime mortgage securities or related to mortgage securities, among other assets. As a result

of adverse market conditions that have unfavorably affected the fair value and liquidity of collateral underlying the

Columbia Portfolio, the Columbia Portfolio was overwhelmed with withdrawal requests from investors and it was

closed with a restriction placed upon the cash redemption ability of its holders in the fourth quarter of 2007.

These Columbia Portfolio units are no longer trading and have no readily determinable market value. Based on

the information available to us, we have estimated the fair value of the Columbia Portfolio units at $0.960 per unit as

of December 25, 2007 and we recorded an unrealized loss on the Columbia Portfolio units of $1.0 million in the

fiscal year ended December 25, 2007. Giving effect to these losses, our investment in the Columbia Portfolio at

December 25, 2007 includes an estimated fair value of approximately $23.2 million. As of December 25, 2007, we

have received $2.4 million of cash redemptions subsequent to the withdrawal restriction and recognized $0.03 mil-

lion of realized losses. Information and the markets relating to these investments remain dynamic, and there may be

further declines in the value of these investments, the value of the collateral held by these entities, and the liquidity

of our investments. To the extent we determine that there is a further decline in fair value, we may recognize

additional losses in future periods up to the aggregate amount of these investments. Subsequent to our December 25,

2007 fiscal year end and through February 22, 2008, the date of our 2007 fiscal year Form 10-K filing, we have

received additional cash redemptions of $8.0 million at approximately $0.986 per unit. We believe cash redemp-

tions of the remaining units of the Columbia Portfolio, as included in our accompanying consolidated financial

statements at December 25, 2007, will be received within the next twelve months based on the redemptions received

to-date; however, no commitments on the timing and ability of future redemptions have been made by the Columbia

Portfolio.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

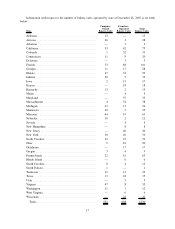

ITEM 2. PROPERTIES

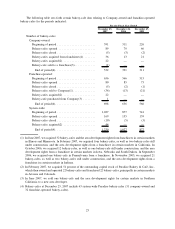

The average size of a Company-owned bakery-cafe is approximately 4,600 square feet for Panera and

3,200 square feet for Paradise. The square footage of each of our fresh dough facilities is provided below. We lease

all of our bakery-cafe locations and fresh dough facilities. Lease terms for our bakery-cafes and fresh dough

facilities are generally for ten years with renewal options at most locations and generally require us to pay a

proportionate share of real estate taxes, insurance, common area, and other operating costs. Many bakery-cafe

leases provide for contingent rental (i.e. percentage rent) payments based on sales in excess of specified amounts.

Certain of our lease agreements provide for scheduled rent increases during the lease terms or for rental payments

commencing at a date other than the date of initial occupancy. See Note 2 to the consolidated financial statements

for further information on our accounting for leases.

15