Panera Bread 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

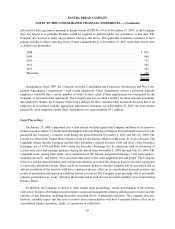

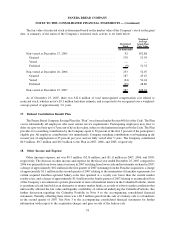

Effective December 27, 2006, the Company adopted the provisions of FIN No. 48, Accounting for Uncertainty

in Income Taxes. FIN No. 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s

financial statements in accordance with SFAS No. 109, Accounting for Income Taxes. FIN No. 48 prescribes a

recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax

position taken or expected to be taken in a tax return. This pronouncement also provides guidance on derecognition,

classification, interest and penalties, accounting in interim periods, disclosure, and transition. As a result of the

implementation of FIN No. 48, the Company increased its existing reserves for uncertain tax positions by

$1.2 million, principally related to state income tax matters. Of this amount, $0.4 million was recorded as a

deferred tax asset relating to the estimated federal tax benefit and $0.8 million was recorded as a cumulative-effect

adjustment to reduce the fiscal 2007 opening balance of retained earnings in the Consolidated Balance Sheets.

As of December 27, 2006, the Company had $2.7 million of total unrecognized tax benefits. If recognized in

full, approximately $2.3 million, net of federal tax benefits, would have been recorded as a reduction of income tax

expense. These unrecognized tax benefits related principally to state tax filing positions and previously deducted

expenses. Estimated interest and penalties related to the underpayment of income taxes are classified as a

component of income tax expense in the Consolidated Statements of Operations and were insignificant during

the fiscal year ended December 25, 2007. Accrued interest and penalties were $0.4 million and $0.3 million as of

December 25, 2007 and December 27, 2006, respectively.

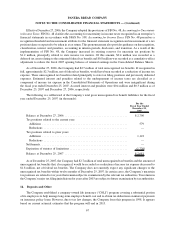

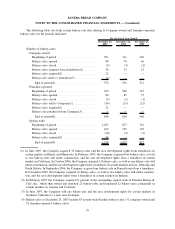

The following is a rollforward of the Company’s total gross unrecognized tax benefit liabilities for the fiscal

year ended December 25, 2007 (in thousands):

For the

Fiscal Year Ended

December 25,

2007

Balance at December 27, 2006 ....................................... $2,700

Tax positions related to the current year:

Additions ..................................................... 579

Reductions .................................................... —

Tax positions related to prior years:

Additions ..................................................... 1,122

Reductions .................................................... —

Settlements ...................................................... —

Expiration of statutes of limitations .................................... (1,720)

Balance at December 25, 2007 ....................................... $2,681

As of December 25, 2007, the Company had $2.7 million of total unrecognized tax benefits and the amount of

unrecognized tax benefits that, if recognized, would be recorded as a reduction of income tax expense decreased to

$1.8 million, net of federal tax benefits. The Company does not currently expect any significant changes to the

unrecognized tax benefits within twelve months of December 25, 2007. In certain cases, the Company’s uncertain

tax positions are related to tax years that remain subject to examination by the relevant tax authorities. Tax returns in

the Company’s major tax filing jurisdictions for years after 2003 are subject to future examination by tax authorities.

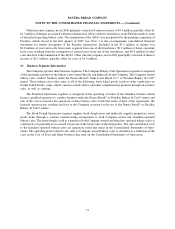

14. Deposits and Other

The Company established a company-owned life insurance (“COLI”) program covering a substantial portion

of its employees to help manage long-term employee benefit cost and to obtain tax deductions on interest payments

on insurance policy loans. However, due to tax law changes, the Company froze this program in 1998. It appears

based on current actuarial estimates that the program will end in 2013.

67

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)