Panera Bread 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.exceed, in the aggregate, $200 million, subject to the arrangement of additional commitments with financial

institutions acceptable to the Company, Bank of America and existing lenders. The Company has not exercised

these requests for increases in available borrowings as of December 25, 2007. The proceeds from the credit facility

will be used for general corporate purposes, including working capital, capital expenditures, permitted acquisitions

and share repurchases to finance the Company’s share repurchase program.

As of December 25, 2007, the Company had a $75.0 million LIBOR rate loan outstanding under the credit

facility based on a one-month LIBOR rate of 4.82 percent plus an Applicable Rate of 0.50 percent. The Company

incurred an inconsequential amount of commitment fees for the fiscal year ended December 25, 2007. As of

December 25, 2007, the Company was in compliance with all covenant requirements in the Credit Agreement. As of

December 25, 2007, accrued interest on the Credit Agreement was $0.3 million.

The Company’s $10.0 million unsecured revolving line of credit expired on December 19, 2006 and was not

renewed. As of December 26, 2006, the Company had a $0.1 million outstanding letter of credit in support of certain

operational activities.

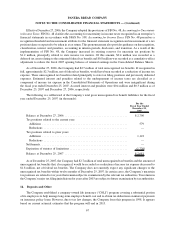

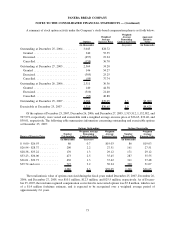

11. Share Repurchase Program

On November 27, 2007, the Company entered into an accelerated share repurchase (“ASR”) agreement with a

financial institution, as well as a written trading plan in compliance with Rule 10b5-1 (“10b5-1 plan”) under the

Securities Exchange Act of 1934, as amended, to purchase up to an aggregate of up to $75.0 million of the

Company’s Class A common stock, both of which are subject to maximum per share purchase prices. The Company

is acquiring these shares as part of a $75.0 million share repurchase program approved by the Company’s Board of

Directors on November 20, 2007. The Company entered into a credit facility that initially provides for $75.0 million

in secured loans to the Company. Proceeds from the credit facility were used to finance the share repurchase

program. See Note 10 for further information with respect to the credit facility.

The number of shares to be repurchased under the ASR program was based generally on the volume-weighted

average price of the Company’s Class A common stock during the term of the agreement. Purchases under the ASR

agreement were subject to collar provisions that would establish minimum and maximum numbers of shares based

on the volume-weighted average share price over an initial hedge period and a maximum share purchase price. The

minimum and maximum numbers of shares that the Company would repurchase pursuant to the ASR agreement

was not known until conclusion of the hedge period, which occurred on December 12, 2007. Because the price of

the Company’s Class A common stock during part or all of the hedge period exceeded the maximum share purchase

price specified in the ASR agreement, no shares were repurchased under the ASR program. Shares were

subsequently repurchased under the 10b5-1 plan. As of December 25, 2007, the Company repurchased a total

of 752,930 common shares at a weighted-average price of $36.02 per share for an aggregate purchase price of

$27.1 million under the 10b5-1 plan. The timing and amount of any shares repurchased under the Company’s share

repurchase program are determined by the Company’s management based on its evaluation of market conditions

and other factors. The repurchase program may be suspended or discontinued at any time. Repurchased shares will

be retired immediately and will resume the status of authorized but unissued shares.

12. Commitments and Contingent Liabilities

Operating Lease Commitments

The Company is obligated under non-cancelable operating leases for its bakery-cafes, fresh dough facilities

and trucks, and administrative offices. Lease terms for its trucks are generally for five to seven years. Lease terms for

its bakery-cafes, fresh dough facilities, and administrative offices are generally for ten years with renewal options at

certain locations and generally require the Company to pay a proportionate share of real estate taxes, insurance,

common area, and other operating costs. Many bakery-cafe leases provide for contingent rental (i.e., percentage

rent) payments based on sales in excess of specified amounts. Certain of the Company’s lease agreements provide

63

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)