Panera Bread 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

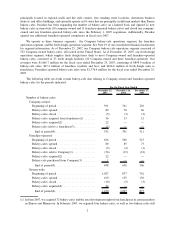

Let me also note that we opened 169 bakery-cafes in 2007, 89 of which were company-owned and 80 of

which were franchise-operated. We finished the year with 1,230 bakery-cafes open in 40 states (532

company-owned and 698 franchise-operated).

With an understanding of the many forces affecting us, we sat down in the fall of 2007 and took a hard

look inward. We knew we needed to build off our strengths and address areas of weakness, all in an effort

to re-engage our record of performance. The plan we developed focused on what has always worked so

well for Panera — concept differentiation as the means to drive transactions. In other words, we need to

have a concept that people are willing to walk across the street and past competitors to reach. But we also

understood that, in order to continue to make investments to drive long term differentiation, we needed to

re-build our credibility. Thus, we created a plan that focused on improving margins while maintaining

transactions and strengthening return on new bakery-cafes.

As this plan has become central to our efforts, let me review the status of that plan with you.

Improve Margins

The first prong in our 2008 plan is to improve margins. In order to do so, we recognized we must focus on

growing gross profit per transaction year-over-year. To that end, we began building a Category

Management function last fall. This team has been focused on effectively executing a high/low pricing

strategy, redefining our menu structure and utilizing our associates to change consumer behavior – all

with the mission of increasing gross profit per transaction.

The manifestation of that work was a retail price increase of approximately 2.5 percent and menu

restructuring in November 2007. This initiative was rigorously tested and preliminary results

demonstrated that we would be able to take these increases with no noticeable degradation in transaction

growth. Our team has identified several additional ways to increase gross profit per transaction without

diminishing our value perception. As such, we implemented another retail price increase of approximately

2.6 percent in early April 2008 and we will be testing additional Category Management initiatives for the

remainder of 2008.

We also made the hard decision to remove Crispani from our menu in January 2008. We expect that the

removal of Crispani will allow us to eliminate labor costs that represent approximately 1 percent of sales

per bakery-cafe per week on a run rate basis. We also expect negligible impact on sales. Thus the removal

of Crispani should be margin and profit positive. Simply put, though we deeply believe in the Crispani

product, our patience for the level of investment needed to change deeply-held consumer behavior was

less in this time of compressed margins.

We are also looking to impact margin through a renewed focus on new bakery-cafe productivity and

Return on Invested Capital, or ROIC. As margins compressed across all bakery-cafes, the sales needed to

meet our ROIC targets went up. We have reviewed our 2008 and 2009 development plans for company-

owned bakery-cafes in the context of the lower margins we ran in 2007 and concluded that a number of

bakery-cafes we hoped to develop no longer met our ROIC hurdle. As a result, we chose not to open

certain planned bakery-cafes and to moderate our growth.

Let me mention one other significant issue that affects our 2008 outlook: the price of wheat. By February

2008, the all-in cost of wheat (including the cost of the wheat futures and the basis paid to the grain

elevators) for the full year was up approximately 140 percent over the prior year. Much of our planning

focus for 2008 has been on deciding when to buy our wheat and how to offset the hyperinflation we have

been experiencing in wheat through retail and dough transfer price increases.