Panera Bread 2007 Annual Report Download - page 52

Download and view the complete annual report

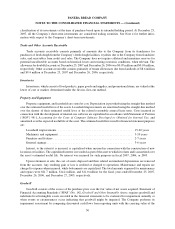

Please find page 52 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Minority interests will be recharacterized as noncontrolling interests and will be reported as a component of equity

separate from the parent’s equity, and purchases or sales of equity interests that do not result in a change in control

will be accounted for as equity transactions. In addition, net income attributable to the noncontrolling interest will

be included in consolidated net income on the face of the income statement and upon a loss of control, the interest

sold, as well as any interest retained, will be recorded at fair value with any gain or loss recognized in earnings.

SFAS No. 160 is effective for financial statements issued for fiscal years beginning after December 15, 2008, and

interim periods within those fiscal years, except for the presentation and disclosure requirements, which will apply

retrospectively. We are currently evaluating the potential impact that the adoption of this statement will have on our

future consolidated financial statements. Currently, only our 51 percent interest in Paradise would be impacted.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We manage our commodity risk in several ways. On occasion, we have entered into swap agreements to

manage our fluctuating butter prices. All derivative instruments are entered into for other than trading purposes. As

of December 25, 2007, we did not have any derivative instruments. In addition, we purchase certain commodities,

such as flour and coffee, for use in our business. These commodities are sometimes purchased under agreements of

one month to one year time frames usually at a fixed price. As a result, we are subject to market risk that current

market prices may be above or below our contractual price.

We are also exposed to market risk primarily from fluctuations in interest rates on our revolving credit facility.

Our revolving credit facility provides for a $75.0 million secured facility under which we may select interest rates

equal to (1) the Base Rate (which is defined as the higher of the Bank of America prime rate and the Federal funds

rate plus 0.50%) or (2) LIBOR. Our borrowings were from a $75.0 million LIBOR rate loan outstanding under our

credit facility at December 25, 2007. A hypothetical one-point interest rate change on the outstanding balance of our

borrowings at December 25, 2007 would have approximately $0.08 million pre-tax impact on our results of

operations.

We intend to expand our operations into Canadian markets in 2008, primarily through franchise agreements.

As of December 25, 2007, we had no foreign exchange rate fluctuation risk.

42