Panera Bread 2007 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.including the pace of expansion, real estate markets, site locations, and the nature of the arrangements negotiated

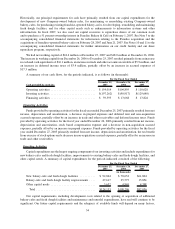

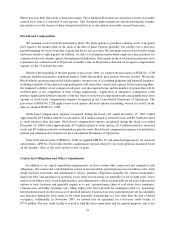

with landlords. We believe that our cash flow from operations and the exercise of employee stock options, as well as

available borrowings under our existing credit facility, will be sufficient to fund our capital requirements for the

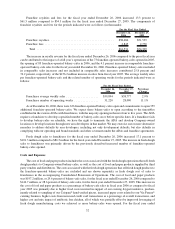

foreseeable future. We currently anticipate total capital expenditures for fiscal year 2008 of approximately

$90 million to $110 million, which consists of the following: $55 million to $65 million related to the opening

of at least 40 new Company-owned bakery-cafes and the costs incurred on early 2009 openings, $20 million to

$25 million related to the remodeling of existing bakery-cafes, $5 million to $8 million related to the opening of new

fresh dough facilities and the remodeling and expansion of existing fresh dough facilities, and $10 million to

$12 million of other capital needs including on our concept, information technology, and infrastructure. We expect

future bakery-cafes will require, on average, an investment per bakery-cafe (excluding pre-opening expenses which

are expensed as incurred) of approximately $1.0 million. Our 2008 projection of capital expenditures for new

Company-owned bakery-cafes reflects our decision to reduce our 2008 bakery-cafe growth in an effort to focus on

our return on invested capital. Our strategy to improve return on invested capital includes raising our sales hurdles

for new bakery-cafes to adjust to the contraction in margins we have experienced. We expect to do this by focusing

our real estate decision-making process to only build bakery-cafes that can deliver a 50 percent or greater

probability against our revised return on investment goals and bakery-cafes that reach mature returns in a shorter

amount of time. As margins improve and the trajectory of our return on invested capital improves, we will once

again consider expanding development as appropriate.

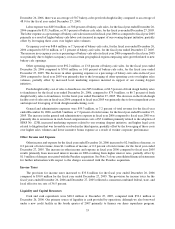

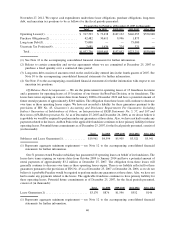

We used $71.0 million of cash flows for acquisitions, net of cash acquired, in fiscal year 2007, $9.1 million

in fiscal year 2006, and $28.3 million in fiscal year 2005. In fiscal year 2007, we acquired 51 percent of the

outstanding stock of Paradise, then owner and operator of 22 bakery-cafes and one commissary and franchisor of

22 bakery-cafes and one commissary, and 36 bakery-cafes, as well as two bakery-cafes still under construction,

from franchisees. We also made required payments of a portion of the remaining acquisition purchase price for

three of our acquisitions in fiscal year 2007. As of December 25, 2007, we had a total of $2.5 million of accrued

purchase price affiliated with acquisitions completed in fiscal years 2006 and 2007, which is anticipated to be

paid within the next twelve months. In the prior years, we acquired significantly fewer bakery-cafes, which

included 13 bakery-cafes, as well as one bakery-cafe still under construction, in fiscal year 2006, and 21 bakery-

cafes, as well as one bakery-cafe still under construction, in fiscal year 2005. See Note 3 to the accompanying

consolidated financial statements for further information with respect to our acquisition activity in fiscal years

2007, 2006 and 2005.

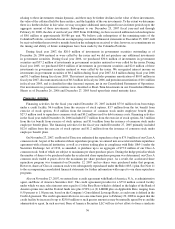

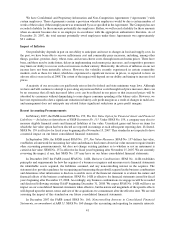

Historically, we invested a portion of our cash balances on hand in a private placement of units of beneficial

interest in the Columbia Strategic Cash Portfolio, or Columbia Portfolio, which is an enhanced cash fund sold as an

alternative to traditional money-market funds, and we appropriately classified the amounts as trading securities in

Cash and Cash Equivalents in the Consolidated Balance Sheets as the fund was considered both short-term and

highly liquid in nature. These investments are subject to credit, liquidity, market and interest rate risk. For example,

the Columbia Portfolio includes investments in certain asset backed securities and structured investment vehicles

that are collateralized by sub-prime mortgage securities or related to mortgage securities, among other assets. As a

result of adverse market conditions that have unfavorably affected the fair value and liquidity of collateral

underlying the Columbia Portfolio, the Columbia Portfolio was overwhelmed with withdrawal requests from

investors and it was closed with a restriction placed upon the cash redemption ability of its holders in the fourth

quarter of 2007. At such time, we reclassified the $26.5 million of units in the Columbia Portfolio to short-term

investments from cash and cash equivalents in our Consolidated Balance Sheets, and as an outflow from investing

activities in our Consolidated Statements of Cash Flows. Additionally, we assessed the fair value of the underlying

collateral for the Columbia Portfolio through review of current investment ratings, as available, coupled with the

evaluation of the liquidation value of assets held by each investment and their subsequent distribution of cash. We

then utilized this assessment of the underlying collateral from multiple indicators of fair value, which were then

discounted to reflect the expected timing of disposition and market risks to arrive at an estimated fair value of the

Columbia Portfolio units of $0.960 per unit as of December 25, 2007. Accordingly, we recognized an unrealized

loss on the Columbia Portfolio units of $1.0 million in the fiscal year ended December 25, 2007 and included the

loss in net cash provided by operating activities. As of December 25, 2007, we have received $2.4 million of cash

redemptions subsequent to the withdrawal restriction, which we classified as investment maturity proceeds

provided by investing activities, and recognized $0.03 million of realized losses. Information and the markets

35