Panera Bread 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For example, in fiscal year 2007, we acquired 36 bakery-cafes from franchisees, as well as two bakery-cafes still

under construction. In addition, on February 1, 2007, we purchased 51 percent of the outstanding stock of Paradise

Bakery & Café, Inc., which we refer to as Paradise, then owner and operator of 22 bakery-cafes and one

commissary, and franchisor of 22 bakery-cafes and one commissary. Any acquisition that we undertake involves

risk, including:

• our ability to successfully achieve anticipated synergies, accurately assess contingent and other liabilities as

well as potential profitability;

• failure to successfully integrate the acquired entity’s operational and support activities;

• unanticipated changes in business and economic conditions;

• limited or no operational experience in the acquired bakery-cafe market or other restaurant concept;

• future impairment charges related to goodwill and other acquired intangible assets; and

• risks of dispute and litigation with the seller, the seller’s landlords, and vendors and other parties.

Any of these factors could strain our financial and management resources as well as negatively impact our

results of operations.

Our operating results fluctuate due to a number of factors, some of which may be beyond our control,

and any of which may adversely affect our financial condition.

Our quarterly operating results may fluctuate significantly because of a number of factors, including the

following, some of which are not within our control:

• changes in our operating costs;

• labor availability and wages of management and associates;

• changes in average weekly sales and comparable bakery-cafe sales, including as a result of the introduction

of new menu items;

• profitability of new bakery-cafes, especially in new markets;

• changes in demographics, consumer preferences and discretionary spending;

• changes in business strategy including concept evolution and new designs;

• fluctuations in supply costs, shortages or interruptions;

• delays in new bakery-cafe openings;

• negative publicity about the ingredients we use or the occurrence of food-borne illnesses or other problems at

our bakery-cafes;

• natural disasters and other calamities; and

• general economic conditions, both nationally and locally.

Additionally, our sales have fluctuated by season due to the number and timing of bakery-cafe openings and

related expense, consumer spending patterns and weather. Historically, sales have been higher during the winter

holiday season as a result of increased traffic, higher baked goods sales and family and community gatherings. In

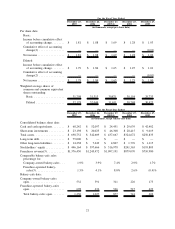

fiscal year 2007, Company-owned bakery-cafes had an aggregate of approximately $197.1 million in sales in the

first quarter which was our lowest recorded relative quarterly sales in fiscal year 2007 and included 14 Company-

owned bakery-cafe openings. Comparatively, in our fourth quarter we had an aggregate of approximately

$255.9 million in sales with 39 Company-owned bakery-cafe openings in that quarter recording the highest

relative quarterly sales for fiscal year 2007.

Accordingly, results for any one quarter or year are not necessarily indicative of results to be expected for any

other quarter or year.

14