Panera Bread 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

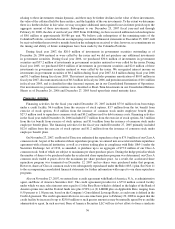

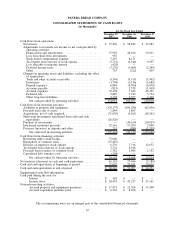

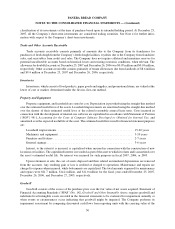

November 27, 2012. We expect cash expenditures under these lease obligations, purchase obligations, long-term

debt, and uncertain tax positions to be as follows for the fiscal periods presented:

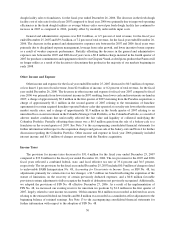

Total In 2008 2009-2010 2011-2012 After 2012

Payments Due by Period as of December 25, 2007 (in thousands)

Operating Leases(1) .................... $ 917,593 $ 73,438 $147,132 $146,055 $550,968

Purchase Obligations(2) ................. 42,482 30,611 9,996 1,875 —

Long-term Debt(3) ..................... 75,000 — — 75,000 —

Uncertain Tax Positions(4) ............... 2,681 1,636 724 321 —

Total ............................. $1,037,756 $105,685 $157,852 $223,251 $550,968

(1) See Note 12 to the accompanying consolidated financial statements for further information.

(2) Relates to certain commodity and service agreements where we are committed at December 25, 2007 to

purchase a fixed quantity over a contracted time period.

(3) Long-term debt consists of amounts owed on the credit facility entered into in the fourth quarter of 2007. See

Note 10 to the accompanying consolidated financial statements for further information.

(4) See Note 13 to the accompanying consolidated financial statements for further information with respect to our

uncertain tax positions.

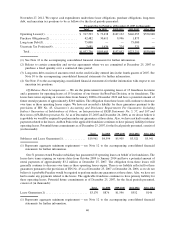

Off-Balance Sheet Arrangements — We are the prime tenant for operating leases of 15 franchisee locations

and a guarantor for operating leases of 15 locations of our former Au Bon Pain Division, or its franchisees. The

leases have terms expiring on various dates from January 2008 to December 2022 and have a potential amount of

future rental payments of approximately $20.0 million. The obligation from these leases will continue to decrease

over time as these operating leases expire. We have not recorded a liability for these guarantees pursuant to the

provisions of FIN No. 45, Guarantor’s Accounting and Disclosure Requirements For Guarantees, Including

Indirect Guarantees of Indebtedness of Others, an Interpretation of FASB Statements No. 5, 57, and 107 and

Rescission of FASB Interpretation No. 34, as of December 25, 2007 and December 26, 2006, as we do not believe it

is probable we would be required to perform under any guarantees at those dates. Also, we have not had to make any

payments related to the leases. Au Bon Pain or the applicable franchisee continues to have primary liability for these

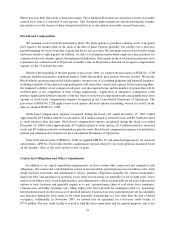

operating leases. Potential future commitments as of December 25, 2007, for the fiscal periods presented, consist of

(in thousands):

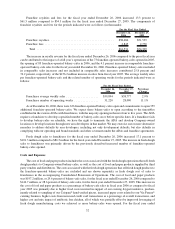

Total In 2008 2009-2010 2011-2012 After 2012

Subleases and Lease Guarantees(1) .............. $19,961 $4,594 $5,905 $3,521 $5,941

(1) Represents aggregate minimum requirement — see Note 12 to the accompanying consolidated financial

statements for further information.

Our 51 percent owned Paradise subsidiary has guaranteed 10 operating leases on behalf of its franchisees. The

leases have terms expiring on various dates from October 2009 to January 2014 and have a potential amount of

rental payments of approximately $3.2 million at December 25, 2007. The obligation from these leases will

generally continue to decrease over time as these operating leases expire. There is no liability reflected for these

guarantees pursuant to the provisions of FIN No. 45 as of December 25, 2007 or December 26, 2006, as we do not

believe it is probable Paradise would be required to perform under any guarantees at those dates. Also, we have not

had to make any payments related to the leases. The applicable franchisee continues to have primary liability for

these operating leases. Potential future commitments as of December 25, 2007, for the fiscal periods presented,

consist of (in thousands):

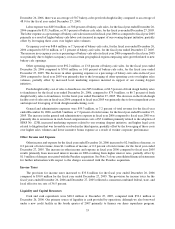

Total In 2008 2009-2010 2011-2012 After 2012

Lease Guarantees(1) .......................... $3,170 $876 $1,596 $552 $146

(1) Represents aggregate minimum requirement — see Note 12 to the accompanying consolidated financial

statements for further information.

40