Panera Bread 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

relating to these investments remain dynamic, and there may be further declines in the value of these investments,

the value of the collateral held by these entities, and the liquidity of the our investments. To the extent we determine

there is a further decline in fair value, we may recognize additional unrecognized losses in future periods up to the

aggregate amount of these investments. Subsequent to our December 25, 2007 fiscal year-end and through

February 22, 2008, the date of our fiscal year 2007 Form 10-K filing, we have received additional cash redemptions

of $8.0 million at approximately $0.986 per unit. We believe cash redemptions of the remaining units of the

Columbia Portfolio, as included in our accompanying consolidated financial statements at December 25, 2007, will

be received within the next twelve months based on the redemptions received to-date; however, no commitments on

the timing and ability of future redemptions have been made by the Columbia Portfolio.

During fiscal year 2007, the $20.0 million of investments in government securities outstanding as of

December 26, 2006 matured or were called by the issuer and we did not purchase any additional investments

in government securities. During fiscal year 2006, we purchased $30.6 million of investments in government

securities and $57.2 million of investments in government securities matured or were called by the issuer. During

fiscal year 2005, we purchased $20.0 million of investments in government securities and $2.0 million of these

investments in government securities matured or were called by the issuer. We recognized interest income on

investments in government securities of $0.2 million during fiscal year 2007, $1.8 million during fiscal year 2006

and $1.3 million during fiscal year 2005. This interest income includes premium amortization of $0.03 million in

fiscal year 2007, discount amortization of $0.3 million in fiscal year 2006, and premium amortization of $0.1 million

in fiscal year 2005, and is classified in other (income) expense, net in our Consolidated Statements of Operations.

Our investments in government securities were classified as Short-Term Investments in our Consolidated Balance

Sheets as of December 26, 2006 and December 27, 2005 based upon their stated maturity dates.

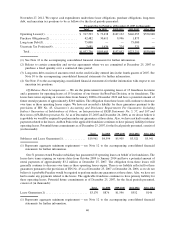

Financing Activities

Financing activities for the fiscal year ended December 25, 2007 included $75.0 million from borrowings

under a credit facility, $6.6 million from the exercise of stock options, $3.7 million from the tax benefit from

exercise of stock options, $1.8 million from the issuance of common stock under employee benefit plans,

$27.5 million used to repurchase common stock and $0.2 million used for debt issuance costs. Financing activities

in the fiscal year ended December 26, 2006 included $7.7 million from the exercise of stock options, $4.3 million

from the tax benefit from exercise of stock options, and $1.6 million from the issuance of common stock under

employee benefit plans. The financing activities for the fiscal year ended December 27, 2005 primarily included

$12.6 million from the exercise of stock options and $1.2 million from the issuance of common stock under

employee benefit plans.

On November 27, 2007, our Board of Directors authorized the repurchase of up to $75.0 million of our Class A

common stock. As part of the authorized share repurchase program, we entered into an accelerated share repurchase

agreement with a financial institution, as well as a written trading plan in compliance with Rule 10b5-1 under the

Securities Exchange Act of 1934, as amended, to purchase up to an aggregate of $75.0 million of our Class A

common stock, both of which are subject to maximum per share purchase prices. During the hedge period in which

the number of shares to be purchased under the accelerated share repurchase program was determined, our Class A

common stock traded at prices above the maximum per share purchase price. As a result, the accelerated share

repurchase program was terminated on December 12, 2007 and no shares were purchased under that program.

However, shares of Class A common stock were subsequently repurchased under the Rule 10b5-1 plan. See Note 11

to the accompanying consolidated financial statements for further information with respect to our share repurchase

programs.

Also on November 27, 2007, we entered into a credit agreement with Bank of America, N.A., as administrative

agent, and Banc of America Securities LLC. The credit agreement provides for a $75.0 million secured facility

under which we may select interest rates equal to (1) the Base Rate (which is defined as the higher of the Bank of

America prime rate and the Federal funds rate plus 0.50%) or (2) LIBOR plus an Applicable Rate, ranging from

0.50 percent to 1.50 percent, based on the Company’s Consolidated Leverage Ratio, as each term is defined in the

Credit Agreement. The credit agreement allows us on a one-time basis prior to February 29, 2008 to request that the

credit facility be increased to up to $250.0 million or such greater amount as may be mutually agreed by us and the

administrative agent. In such an event, Banc of America Securities LLC will use its best efforts to form a syndicate

36