Panera Bread 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

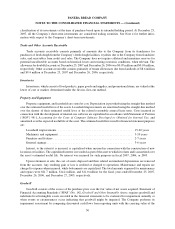

Effective December 28, 2005, the Company adopted the fair value recognition provisions of SFAS No. 123R,

which requires all stock-based compensation, including grants of employee stock options, to be recognized in the

statement of operations based on their fair values. The Company adopted this accounting treatment using the

modified prospective transition method, as permitted under SFAS No. 123R; therefore results for prior periods have

not been restated. The Company uses the Black-Scholes option pricing model which requires extensive use of

accounting judgment and financial estimates, including estimates of the expected term participants will retain their

vested stock options before exercising them, the estimated volatility of the Company’s common stock price over the

expected term, and the number of options that will be forfeited prior to the completion of their vesting requirements.

The provisions of SFAS No. 123R apply to new stock options and stock options outstanding, but not yet vested, on

the date the Company adopted SFAS No. 123R.

Stock-based compensation expense recognized during the fiscal year ended December 25, 2007 totaled

approximately $3.9 million related to stock options, $2.1 million related to restricted stock, and $0.3 million related

to stock purchase plan discounts. Stock-based compensation expense recognized during the fiscal year ended

December 26, 2006 totaled approximately $5.9 million related to stock options, $1.4 million related to restricted

stock, and $0.3 million related to stock purchase plan discounts. Stock-based compensation expense was included in

general and administrative expenses in the accompanying Consolidated Statements of Operations.

Prior to the adoption of SFAS No. 123R, the Company accounted for stock-based compensation using the

intrinsic value method prescribed in Accounting Principles Board Opinion (APB) No. 25, Accounting for Stock

Issued to Employees, and related interpretations. Accordingly, prior to fiscal 2006, stock-based compensation was

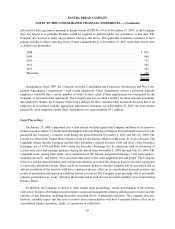

included as pro forma disclosure in the financial statement footnotes. The Company’s pro forma net income and pro

forma earnings per share for the fiscal year ended December 27, 2005 had compensation costs for the Company’s

stock option plans been determined under the fair value based method and recognition provisions of SFAS No. 123R

at the grant date, would have been as follows (in thousands, except per share amounts):

Fiscal Year Ended

December 27,

2005

Net income, as reported ............................................ $52,183

Add:

Total stock-based compensation expense included in reported net income, net

oftax ...................................................... 513

Deduct:

Compensation expense determined using Black-Scholes, net of tax ........... (4,628)

Pro forma net income .............................................. $48,068

Net income per share:

Basic, as reported ............................................... $ 1.69

Basic, pro forma ................................................ $ 1.56

Diluted, as reported .............................................. $ 1.65

Diluted, pro forma............................................... $ 1.52

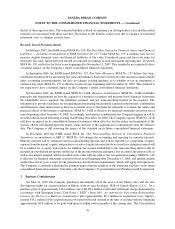

Asset Retirement Obligations

The Company recognizes the future cost to comply with lease obligations at the end of a lease as it relates to

tangible long-lived assets in accordance with the provisions of SFAS No. 143, Accounting for Asset Retirement

Obligations, as interpreted by FIN No. 47, Accounting for Conditional Asset Retirement Obligations. A liability for

the fair value of an asset retirement obligation along with a corresponding increase to the carrying value of the

related long-lived asset is recorded at the time a lease agreement is executed. The Company amortizes the amount

added to property and equipment and recognizes accretion expense in connection with the discounted liability over

55

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)