Panera Bread 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

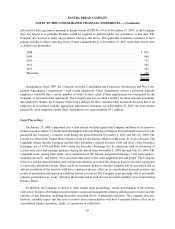

has received additional cash redemptions of $8.0 million at approximately $0.986 per unit. The Company believes

cash redemptions of the remaining units of the Columbia Portfolio, as included in the Company’s accompanying

consolidated financial statements at December 25, 2007, will be received within the next twelve months based on

the redemptions received to-date; however, no commitments on the timing and ability of future redemptions have

been made by the Columbia Portfolio.

At December 26, 2006, the Company’s short-term investments consist of treasury notes and government

agency securities issued and fully guaranteed by the United States. There were $20.0 million of investments in

government securities at December 26, 2006 which were classified as held-to-maturity as the Company had the

intent and ability to hold the securities to maturity. During fiscal year 2007, the $20.0 million of the investments in

government securities outstanding at December 26, 2006 matured or were called by the issuer and no additional

investments in government securities were purchased by the Company. During fiscal year 2006, $30.6 million of

investments in government securities were purchased by the Company and $57.2 million of these investments

matured or were called by the issuer. During fiscal years 2007, 2006, and 2005, the Company recognized interest

income on these investments of $0.2 million, $1.8 million and $1.3 million, respectively, which includes premium

amortization of $0.03 million in fiscal year 2007, discount amortization of $0.3 million in fiscal year 2006, and

premium amortization of $0.1 million in fiscal year 2005, and is classified in other (income) expense, net in the

Consolidated Statements of Operations. The Company’s investments in government securities were classified as

Short-Term Investments in the Consolidated Balance Sheets as of December 26, 2006 based upon their stated

maturity dates.

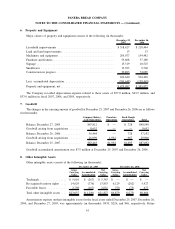

5. Inventories

Inventories consist of the following (in thousands):

December 25,

2007

December 26,

2006

Food:

Fresh dough facilities:

Raw materials ........................................ $ 2,849 $2,488

Finished goods ....................................... 421 332

Bakery-cafes:

Raw materials ........................................ 6,353 4,721

Paper goods ............................................. 1,635 999

Retail merchandise ........................................ 136 174

$11,394 $8,714

60

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)