Panera Bread 2007 Annual Report Download - page 33

Download and view the complete annual report

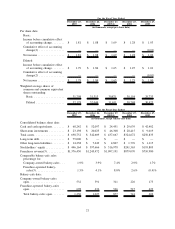

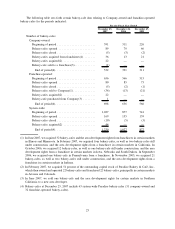

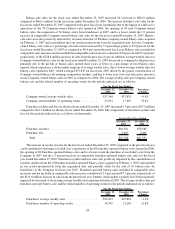

Please find page 33 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of $38,318 ($37,348 for Company-owned bakery-cafes and $38,777 for franchise-operated bakery-cafes), and 139

new bakery-cafes opened system-wide, including 66 Company-owned bakery-cafes and 73 franchise-operated

bakery-cafes. The fiscal 2005 results of $1.65 per diluted share do not include stock-based compensation expense of

$0.13 per diluted share because SFAS No. 123R, Accounting for Stock-based Compensation, did not require the

expensing of stock options in fiscal 2005. See “Reconciliation of Non-GAAP Measurements to GAAP Results”

later in this section in this Form 10-K.

We include in this report information on Company, franchisee and/or system-wide comparable bakery-cafe

sales percentages. Franchise-operated and system-wide comparable bakery-cafe sales percentages are non-GAAP

measures, which should not be considered in isolation or as a substitute for other measures of performance prepared

in accordance with Generally Accepted Accounting Principles, or GAAP, and may not be comparable to system-

wide comparable bakery-cafe sales as defined or used by other companies. We do not record franchise-operated

bakery-cafe sales as revenues. However, royalty revenues are calculated based on a percentage of franchise-

operated bakery-cafe sales, as reported by franchisees. We use franchise-operated and system-wide sales infor-

mation internally in connection with store development decisions, planning, and budgeting analyses. We believe

franchise-operated and system-wide sales information is useful in assessing consumer acceptance of our brand,

facilitates an understanding of financial performance and the overall direction and trends of sales and operating

income, helps us appreciate the effectiveness of our advertising and marketing initiatives to which our franchisees

contribute based on a percentage of their sales, and provides information that is relevant for comparison within the

industry.

Our revenues are derived from Company-owned bakery-cafe sales, fresh dough sales to franchisees, and

franchise royalties and fees. Fresh dough sales to franchisees are primarily the sales of dough products and sales of

tuna and cream cheese to certain of our franchisees. Franchise royalties and fees include royalty income and

franchise fees. The cost of food and paper products, labor, occupancy, and other operating expenses relate primarily

to Company-owned bakery-cafe sales. The cost of fresh dough sales relates primarily to the sale of fresh dough

products and tuna and cream cheese to franchisees. General and administrative, depreciation and amortization, and

pre-opening expenses relate to all areas of revenue generation.

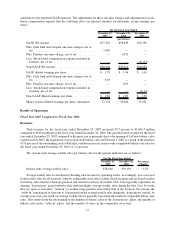

In fiscal 2006, we adopted a new quarterly fiscal calendar whereby each of our quarters include 13 weeks

(4 week, 5 week, and 4 week period progressions in each quarter), rather than our prior quarterly fiscal calendar

which had 16 weeks in the first quarter and 12 weeks in the second, third, and fourth quarters (4 week period

progressions in each quarter).

In fiscal year 2005, we changed our fiscal week to end on Tuesday rather than Saturday, with our fiscal year

ending on the last Tuesday in December. This change allowed us to better serve customers by shifting the weekly

closing activities to a less busy day of the week. As a result, our 2005 fiscal year ended on December 27, 2005

instead of December 31, 2005 and, therefore, consisted of fifty-two and a half weeks rather than the fifty-three week

year that would have resulted without the calendar change. These additional three days in fiscal year 2005 did not

have a material impact on our financial statements. As a result of this calendar change, the next fifty-three week

fiscal year will occur in fiscal year 2008.

23