Panera Bread 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income Taxes

The provision for income taxes is determined in accordance with the provisions of SFAS No. 109, Accounting

for Income Taxes. Under this method, deferred tax assets and liabilities are recognized for the future tax

consequences attributable to differences between the financial statement carrying amounts of existing assets

and liabilities and their respective tax basis. Deferred tax assets and liabilities are measured using enacted income

tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be

recovered or settled. Any effect on deferred tax assets and liabilities of a change in tax rates is recognized in income

in the period that includes the enactment date.

In July 2006, the FASB issued Interpretation (“FIN”) No. 48, Accounting for Uncertainty in Income Taxes.

FIN No. 48 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financials in

accordance with SFAS No. 109. FIN No. 48 prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. This

pronouncement also provides guidance on derecognition, classification, interest and penalties, accounting in

interim periods, disclosure, and transition. Effective December 27, 2006, the Company adopted the provisions of

FIN No. 48 and the provisions of FIN No. 48 have been applied to all income tax positions commencing from that

date. The cumulative effect of applying the provisions of FIN No. 48 was recorded as an adjustment to reduce the

fiscal 2007 opening balance of retained earnings in the Consolidated Balance Sheets as of December 27, 2006. The

Company classifies estimated interest and penalties related to the underpayment of income taxes as a component of

income taxes in the accompanying Consolidated Statements of Operations.

Prior to fiscal 2007, the Company determined its tax contingencies in accordance with SFAS No. 5, Accounting

for Contingencies. The Company recorded estimated tax liabilities to the extent the contingencies were probable

and could be reasonably estimated.

Capitalization of Certain Development Costs

The Company has elected to account for construction costs in a manner similar to SFAS No. 67, Accounting for

Costs and Initial Rental Operations of Real Estate Projects. The Company capitalizes direct and indirect costs

clearly associated with the acquisition, development, design, and construction of new bakery-cafe locations and

fresh dough facilities as these costs have a future benefit to the projects. The types of specifically identifiable costs

capitalized by the Company includes primarily payroll and payroll related taxes and benefit costs incurred within

the Company’s development department. The Company’s development department focuses solely on activities

involving the acquisition, development, design, and construction of bakery-cafes and fresh dough facilities. The

Company does not consider for capitalization payroll or payroll-related costs incurred in other departments,

including general and administrative functions, as these other departments do not directly support the acquisition,

development, design, and construction of bakery-cafes and fresh dough facilities. The Company uses an activity-

based methodology to determine the amount of costs incurred within the development department for Company-

owned projects, which are capitalized, and those for franchise-operated projects and general and administrative

activities, which both are expensed as incurred. If the Company subsequently makes a determination that a site for

which development costs have been capitalized will not be acquired or developed, any previously capitalized

development costs are expensed and included in general and administrative expenses in the accompanying

Consolidated Statements of Operations.

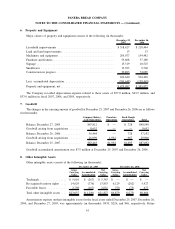

The Company capitalized $10.2 million, $9.1 million, and $7.0 million direct and indirect costs related to the

development of Company-owned bakery-cafes for the fiscal years ended December 25, 2007, December 26, 2006,

and December 27, 2005, respectively. The Company amortizes capitalized development costs for each bakery-cafe

and fresh dough facility using the straight-line method over the shorter of their estimated useful lives or the related

reasonably assured lease term. In addition, the Company assesses the recoverability of capitalized costs through the

performance of impairment analyses on an individual bakery-cafe and fresh dough facility basis pursuant to

SFAS No. 144, Accounting for the Impairment or Disposal of Long-Lived Assets.

52

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)