Panera Bread 2007 Annual Report Download - page 40

Download and view the complete annual report

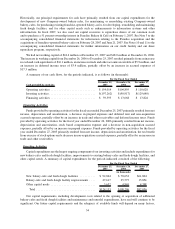

Please find page 40 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.dough facility sales to franchisees, for the fiscal year ended December 26, 2006. The decrease in the fresh dough

facility cost of sales rate for fiscal year 2007 compared to fiscal year 2006 was primarily due to improved operating

efficiencies in the fresh dough facilities as average bakery-cafes served per fresh dough facility has continued to

increase in 2007 as compared to 2006, partially offset by modestly unfavorable input costs.

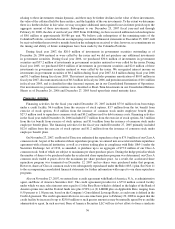

General and administrative expenses was $69.0 million, or 6.5 percent of total revenue, for the fiscal year

ended December 25, 2007 and $59.3 million, or 7.2 percent of total revenue, for the fiscal year ended December 26,

2006. The decrease in the general and administrative expenses rate between the 2007 and 2006 fiscal years were

primarily due to disciplined expense management, leverage from sales growth, and lower incentive bonus expense

as a result of weaker corporate performance. Partially offsetting the decrease in the general and administrative

expenses rate between the 2007 and 2006 fiscal years were a $0.8 million charge incurred in the fourth quarter of

2007 for purchase commitments and equipment related to our Crispani»hand-crafted pizza product that Panera will

no longer utilize as a result of the decision to discontinue this product in the majority of our markets beginning in

early 2008.

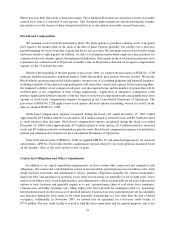

Other Income and Expense

Other income and expense for the fiscal year ended December 25, 2007 decreased to $0.3 million of expense,

or less than 0.1 percent of total revenue, from $2.0 million of income, or 0.2 percent of total revenue, for the fiscal

year ended December 26, 2006. The decrease in other income and expense for fiscal year 2007 compared to fiscal

year 2006 was primarily from lower interest income in 2007 resulting from lower cash and investments on-hand in

2007; a charge of approximately $0.2 million in the first quarter of 2007 stemming from the Paradise acquisition; a

charge of approximately $1.1 million in the second quarter of 2007 relating to the termination of franchise

agreements for certain acquired franchise-operated bakery-cafes that operated at a royalty rate lower that the current

market royalty rates; and a charge of approximately $1.0 million in the fourth quarter of 2007 relating to an

unrealized loss on our investment in the Columbia Strategic Cash Portfolio, or the Columbia Portfolio, as a result of

adverse market conditions that unfavorably affected the fair value and liquidity of collateral underlying the

Columbia Portfolio. Partially offsetting these items was a $0.5 million gain from the sale of a bakery-cafe to a

franchisee in the second quarter of 2007. See Note 3 to the accompanying consolidated financial statements for

further information with respect to the acquisition charges and gain on sale of the bakery-cafe and Note 4 for further

discussion regarding the Columbia Portfolio. Other income and expense in fiscal year 2006 primarily included

interest income and $1.5 million of charges associated with the Paradise acquisition.

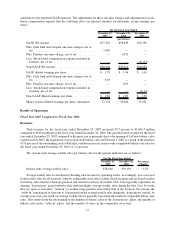

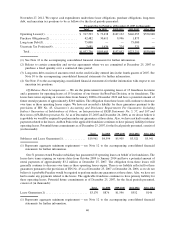

Income Taxes

The provision for income taxes decreased to $31.4 million for the fiscal year ended December 25, 2007

compared to $33.8 million for the fiscal year ended December 26, 2006. The tax provision for the 2007 and 2006

fiscal years reflected a combined federal, state, and local effective tax rate of 35.4 percent and 36.5 percent,

respectively. The tax provision for the fiscal year ended December 25, 2007 included $0.9 million of charges related

to unfavorable FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, or FIN No. 48, tax

adjustments primarily for certain state tax law changes; a $1.5 million tax benefit reflecting the expiration of the

statute of limitations on the recovery of certain previously deducted expenses; and a $0.8 million favorable

provision to return adjustment to fully recognize the benefit of deductions not previously recognized. Additionally,

we adopted the provisions of FIN No. 48 effective December 27, 2006. As a result of the implementation of

FIN No. 48, we increased our existing reserves for uncertain tax positions by $1.2 million in the first quarter of

2007, largely related to state income tax matters. Of this amount, $0.4 million was recorded as deferred tax assets

relating to the estimated federal tax benefits and $0.8 million was recorded as a cumulative-effect adjustment to the

beginning balance of retained earnings. See Note 13 to the accompanying consolidated financial statements for

further information with respect to the adoption of FIN No. 48.

30