Panera Bread 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.agreements provide for scheduled rent increases during the lease terms or for rental payments commencing at a date

other than the date of initial occupancy. The Company includes any rent escalations and construction period and

other rent holidays in its determination of straight-line rent expense. Therefore, rent expense for new locations is

charged to expense beginning with the start of the construction period.

The Company records landlord allowances related to non-structural building improvements as deferred rent,

which is included in accrued expenses or deferred rent in the accompanying Consolidated Balance Sheets based on

their short-term or long-term nature. This deferred rent is amortized over the reasonably assured lease term as a

reduction of rent expense.

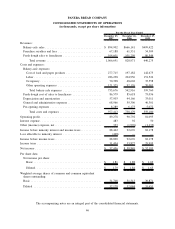

Earnings Per Share Data

Earnings per share is based on the weighted average number of shares outstanding during the period after

consideration of the dilutive effect, if any, for common stock equivalents, including stock options, restricted stock,

and other stock-based compensation. Earnings per common share are computed in accordance with SFAS No. 128,

Earnings Per Share, which requires companies to present basic earnings per share and diluted earnings per share.

Basic earnings per share are computed by dividing net income by the weighted average number of shares of

common stock outstanding during the year. Diluted earnings per common share are computed by dividing net

income by the weighted average number of shares of common stock outstanding and dilutive securities outstanding

during the year.

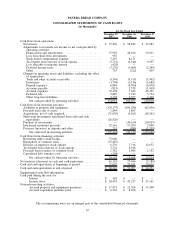

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments, which include short-term investments in

trading and held-to-maturity securities, accounts receivable, accounts payable, and other accrued expenses,

approximate their fair values due to their short maturities. Further, held-to-maturity securities are stated at

amortized cost, adjusted for amortization of premiums to maturity using the effective interest method, which

approximates fair value at December 25, 2007. The Company’s investments in trading securities are stated at fair

value, with gains or losses resulting from changes in fair value recognized currently in earnings as other (income)

expense.

Derivative Financial Instruments

The Company periodically enters into swap agreements to manage fluctuating commodity prices. Swap

agreements designated at inception as a hedge are accounted for under the deferral method, with gains and losses

from hedging activity included in the cost of sales as those inventories are sold or as the anticipated hedge

transaction occurs. Swap agreements not designated as effective hedges of firm commitments or anticipated

underlying transactions are marked to market at the end of the reporting period, with the resulting gains or losses

recognized in cost of sales. The Company does not invest in derivative financial instruments for trading purposes. At

December 25, 2007 and December 26, 2006, the Company did not have any outstanding derivative financial

instruments.

Stock-Based Compensation

The Company maintains several stock-based incentive plans. The Company grants options to purchase

common stock at an option price equal to the market value of the stock at the date of grant. Options generally vest

ratably over a four-year period beginning two years from date of grant and have a six-year term. The Company also

grants restricted stock with vesting and terms similar to option grants. In addition, the Company offers a stock

purchase plan where employees may purchase the Company’s common stock each calendar quarter through payroll

deductions. Participants in the stock purchase plan may elect to purchase the Company’s common stock at

85 percent of market value on the purchase date. This discount is recorded as additional compensation expense.

54

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)