Panera Bread 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividend Policy

We routinely evaluate various options for the use of our capital, including the potential issuance of dividends;

however, we have never paid cash dividends on our capital stock and do not have current plans to pay cash dividends

in 2008 as we currently intend to re-invest earnings in continued growth of our operations.

Share Repurchase Program

On November 27, 2007, our Board of Directors authorized the repurchase of up to $75.0 million of our Class A

common stock. As part of the authorized share repurchase program, we entered into an accelerated share repurchase

agreement with a financial institution as well as a written trading plan in compliance with Rule 10b5-1 under the

Securities Exchange Act of 1934 to purchase up to an aggregate of $75.0 million of our Class A common stock, both

of which are subject to maximum per share purchase prices. During the hedge period in which the number of shares

to be purchased under the accelerated share repurchase program was determined, our Class A common stock traded

at prices above the maximum per share purchase price. As a result, the accelerated share repurchase program was

terminated December 12, 2007 and no shares were purchased under that program. However, shares were

subsequently repurchased under the Rule 10b5-1 plan. The repurchase program may be suspended or discontinued

at any time. Repurchased shares will be retired immediately and will resume the status of authorized but unissued

shares.

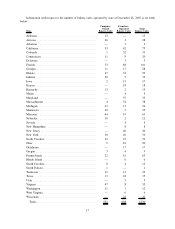

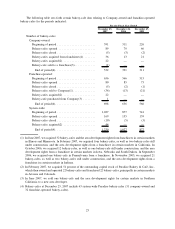

During the fourth quarter of fiscal 2007, we repurchased Class A common stock as follows:

Period

Total Number

of Shares

Purchased

Average

Price Paid

per Share

Total Number of

Shares Purchased as

Part of Publicly

Announced Program

Approximate Dollar

Value of Shares

That May Yet Be

Purchased Under the

Announced Program

September 26, 2007 - October 23, 2007 ..... 38(1) $41.36 — $ —

October 24, 2007 - November 27, 2007 ..... 187(1) $37.01 — $75,000,000

November 28, 2007 - December 25, 2007 . . . 752,930(2) $36.02 752,930 $47,876,513

Total . . . .......................... 753,155 $36.02 752,930 $47,876,513

(1) Represents Class A common stock surrendered by participants in the 2005 Long-Term Incentive Program

(“2005 LTIP”) and repurchased by us pursuant to the terms of the 2005 LTIP and the applicable award

agreements and not pursuant to publicly announced share repurchase programs.

(2) As described above, as of December 25, 2007, 752,930 shares of Class A common stock were repurchased

under a Rule 10b5-1 plan. For further information regarding the share repurchase program, refer to the

“Management Discussion and Analysis of Financial Condition and Results of Operations” section in this

Form 10-K.

19