Panera Bread 2007 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

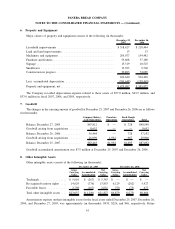

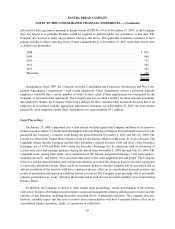

6. Property and Equipment

Major classes of property and equipment consist of the following (in thousands):

December 25,

2007

December 26,

2006

Leasehold improvements ................................... $318,427 $ 218,464

Land and land improvements ................................ 13 13

Machinery and equipment .................................. 205,077 154,442

Furniture and fixtures ...................................... 53,608 37,189

Signage ................................................ 15,319 10,525

Smallwares ............................................. 13,393 9,702

Construction in progress .................................... 30,803 74,085

636,640 504,420

Less: accumulated depreciation ............................... (206,648) (158,443)

Property and equipment, net ................................. $429,992 $ 345,977

The Company recorded depreciation expense related to these assets of $57.0 million, $43.9 million, and

$33.0 million in fiscal 2007, 2006, and 2005, respectively.

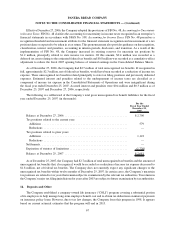

7. Goodwill

The changes in the carrying amount of goodwill at December 25, 2007 and December 26, 2006 are as follows

(in thousands):

Company Bakery-

Cafe Operations

Franchise

Operations

Fresh Dough

Operations Total

Balance December 27, 2005 ............ $47,812 $ — $ 728 $48,540

Goodwill arising from acquisitions ....... 8,652 — — 8,652

Balance December 26, 2006 ............ 56,464 — 728 57,192

Goodwill arising from acquisitions ....... 26,999 1,934 967 29,900

Balance December 25, 2007 ............ $83,463 $1,934 $1,695 $87,092

Goodwill accumulated amortization was $7.9 million at December 25, 2007 and December 26, 2006.

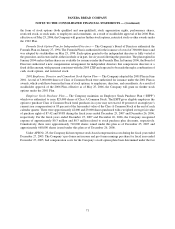

8. Other Intangible Assets

Other intangible assets consist of the following (in thousands):

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

December 25, 2007 December 26, 2006

Trademark ................. $ 5,610 $ (267) $ 5,343 $ — $ — $ —

Re-acquired territory rights . . . . 14,629 (776) 13,853 6,129 (202) 5,927

Favorable leases............. 2,798 (167) 2,631 750 (73) 677

Total other intangible assets . . . . $23,037 $(1,210) $21,827 $6,879 $(275) $6,604

Amortization expense on these intangible assets for the fiscal years ended December 25, 2007, December 26,

2006, and December 27, 2005, was approximately (in thousands): $935, $226, and $46, respectively. Future

61

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)