Panera Bread 2007 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

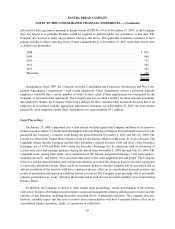

reflected for these guarantees pursuant to the provisions of FIN No. 45 as of December 25, 2007, as the Company

does not believe it is probable Paradise would be required to perform under any guarantees at that date. The

Company has not had to make any payments related to the leases. The applicable franchisee continues to have

primary liability for these operating leases. Future commitments as of December 25, 2007 under these leases were

as follows (in thousands):

2008 ................................................................. $ 876

2009 ................................................................. 884

2010 ................................................................. 712

2011 ................................................................. 365

2012 ................................................................. 187

Thereafter ............................................................. 146

$3,170

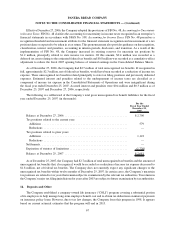

Beginning in fiscal 2003, the Company executed Confidential and Proprietary Information and Non-Com-

petition Agreements (“Agreements”) with certain employees. These Agreements contain a provision whereby

employees would be due a certain number of weeks of their salary if their employment was terminated by the

Company as specified in the Agreement. The Company has not recorded a liability for these amounts potentially

due employees. Rather, the Company will record a liability for these amounts when an amount becomes due to an

employee in accordance with the appropriate authoritative literature. As of December 25, 2007, the total amount

potentially owed employees under these Agreements was approximately $9.1 million.

Legal Proceedings

On January 25, 2008, a purported class action lawsuit was filed against the Company and three of its current or

former executive officers by the Western Washington Laborers-Employers Pension Trust on behalf of investors who

purchased the Company’s common stock during the period between November 1, 2005 and July 26, 2006. The

lawsuit was filed in the United States District Court for the Eastern District of Missouri, St. Louis Division. The

complaint alleges that the Company and the other defendants violated Sections 10(b) and 20(a) of the Securities

Exchange Act of 1934 and Rule 10b-5 under the Securities Exchange Act in connection with its disclosure of

system-wide sales and earnings guidance during the period from November 1, 2005 through July 26, 2006. The

complaint seeks, among other relief, class certification of the lawsuit, unspecified damages, costs and expenses,

including attorneys’ and experts’ fees, and such other relief as the court might find just and proper. The Company

believes it and the other defendants have meritorious defenses to each of the claims in this lawsuit and it is prepared

to vigorously defend the lawsuit. There can be no assurance, however, that the Company will be successful, and an

adverse resolution of the lawsuit could have a material adverse effect on its consolidated financial position and

results of operations in the period in which the lawsuit is resolved. The Company is not presently able to reasonably

estimate potential losses, if any, related to the lawsuit and as such, has not recorded a liability in its Consolidated

Balance Sheets.

In addition, the Company is subject to other routine legal proceedings, claims and litigation in the ordinary

course of its business. Defending lawsuits requires significant management attention and financial resources and the

outcome of any litigation, including the matter described above, is inherently uncertain. The Company does not,

however, currently expect that the costs to resolve these routine matters will have a material adverse effect on its

consolidated financial position, results of operations or cash flows.

65

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)