Panera Bread 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

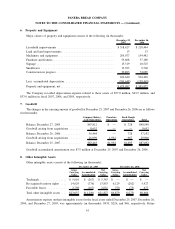

for scheduled rent increases during the lease terms or for rental payments commencing at a date other than the date

of initial occupancy.

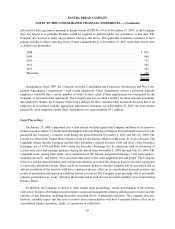

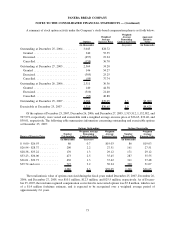

Aggregate minimum requirements under non-cancelable operating leases, excluding contingent liabilities, as

of December 25, 2007, were as follows (in thousands):

2008 ............................................................... $ 73,438

2009 ............................................................... 73,653

2010 ............................................................... 73,479

2011 ............................................................... 72,863

2012 ............................................................... 73,192

Thereafter ........................................................... 550,968

$917,593

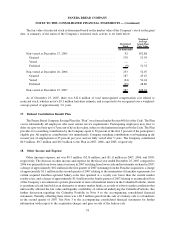

Rental expense under operating leases was approximately $64.4 million, $45.6 million, and $33.0 million in

fiscal 2007, 2006, and 2005, respectively, which included contingent (i.e. percentage rent) payments of $1.0 million,

$0.8 million, and $0.8 million, respectively.

In accordance with SFAS No. 143, as interpreted by FIN No. 47, the Company has recognized asset retirement

obligations for the future cost to comply with lease obligations at the end of a lease as it relates to tangible long-lived

assets. The liability as of December 25, 2007 and December 26, 2006 was $2.9 million and $2.2 million,

respectively, and is included in other long-term liabilities in the accompanying Consolidated Balance Sheets.

Lease Guarantees

The Company is the prime tenant for operating leases of 15 franchisee locations and a guarantor for operating

leases of 15 locations of its former Au Bon Pain division, or its franchisees. These leases have terms expiring on

various dates from January 2008 to December 2022 and have a potential amount of future rental payments of

approximately $20.0 million as of December 25, 2007. The obligation from these leases will generally continue to

decrease over time as these operating leases expire. The Company has not recorded a liability for these guarantees

pursuant to the provisions of FIN No. 45, Guarantor’s Accounting and Disclosure Requirements For Guarantees,

Including Indirect Guarantees of Indebtedness of Others, an Interpretation of FASB Statements No. 5, 57, and 107

and Rescission of FASB Interpretation No. 34, as of December 25, 2007, as the Company does not believe it is

probable it would be required to perform under any guarantees at that date. Also, the Company has not had to make

any payments related to the leases. Au Bon Pain or the applicable franchisees continue to have primary liability for

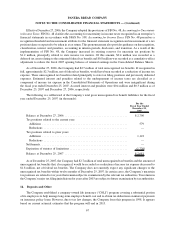

these operating leases. Future commitments as of December 25, 2007 under these leases were as follows (in

thousands):

2008 ................................................................ $ 4,594

2009 ................................................................ 3,697

2010 ................................................................ 2,208

2011 ................................................................ 1,787

2012 ................................................................ 1,734

Thereafter ............................................................ 5,941

$19,961

The Company’s 51 percent owned Paradise subsidiary has guaranteed 10 operating leases on behalf of its

franchisees. The leases have terms expiring on various dates from October 2009 to January 2014 and have a

potential amount of future rental payments of approximately $3.2 million as of December 25, 2007. The obligation

from these leases will generally continue to decrease over time as these operating leases expire. There is no liability

64

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)