Panera Bread 2007 Annual Report Download - page 66

Download and view the complete annual report

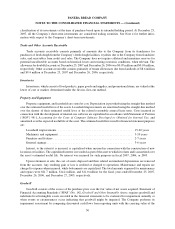

Please find page 66 of the 2007 Panera Bread annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the life of the respective lease. The estimated liability is based on experience in closing bakery-cafes and the related

external cost associated with these activities. Revisions to the liability could occur due to changes in estimated

retirement costs or changes in lease term.

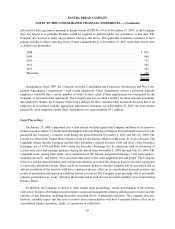

Recently Issued Pronouncements

In February 2007, the FASB issued SFAS No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities — Including an Amendment of FASB Statement No. 115. Under SFAS No. 159, a company may elect to

measure eligible financial assets and financial liabilities at fair value. Unrealized gains and losses on items for

which the fair value option has been elected are reported in earnings at each subsequent reporting date. If elected,

SFAS No. 159 is effective for fiscal years beginning after November 15, 2007. This standard is not expected to have

a material impact on the Company’s future consolidated financial statements.

In September 2006, the FASB issued SFAS No. 157, Fair Value Measures. SFAS No. 157 defines fair value,

establishes a framework for measuring fair value and enhances disclosures about fair value measures required under

other accounting pronouncements, but does not change existing guidance as to whether or not an instrument is

carried at fair value. SFAS No. 157 is effective for fiscal years beginning after November 15, 2007. This standard is

not expected to have a material impact on the Company’s future consolidated financial statements.

In December 2007, the FASB issued SFAS No. 141R, Business Combinations. SFAS No. 141R establishes

principles and requirements for how the acquirer of a business recognizes and measures in its financial statements

the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree. The

statement also provides guidance for recognizing and measuring the goodwill acquired in the business combination

and determines what information to disclose to enable users of the financial statement to evaluate the nature and

financial effects of the business combination. SFAS No. 141R is effective for financial statements issued for fiscal

years beginning after December 15, 2008. Accordingly, any business combinations the Company engages in will be

recorded and disclosed following existing GAAP until December 30, 2008. The Company expects SFAS No. 141R

will have an impact on its consolidated financial statements when effective, but the nature and magnitude of the

specific effects will depend upon the nature, terms and size of the acquisitions it consummates after the effective

date. The Company is still assessing the impact of this standard on its future consolidated financial statements.

In December 2007 the FASB issued SFAS No. 160, Noncontrolling Interests in Consolidated Financial

Statements, an amendment of ARB 51. SFAS No. 160 changes the accounting and reporting for minority interests.

Minority interests will be recharacterized as noncontrolling interests and will be reported as a component of equity

separate from the parent’s equity, and purchases or sales of equity interests that do not result in a change in control will

be accounted for as equity transactions. In addition, net income attributable to the noncontrolling interest will be

included in consolidated net income on the face of the income statement and upon a loss of control, the interest sold, as

well as any interest retained, will be recorded at fair value with any gain or loss recognized in earnings. SFAS No. 160

is effective for financial statements issued for fiscal years beginning after December 15, 2008, and interim periods

within those fiscal years, except for the presentation and disclosure requirements, which will apply retrospectively.

The Company is currently evaluating the potential impact that the adoption of this statement will have on its future

consolidated financial statements. Currently, only the Company’s 51 percent interest in Paradise would be impacted.

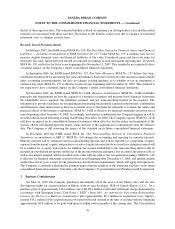

3. Business Combinations

On June 21, 2007, the Company purchased substantially all of the assets of ten bakery-cafes and the area

development rights for certain markets in Illinois from its area developer, SLB of Central Illinois, L.L.C., for a

purchase price of approximately $16.6 million, net of the $0.4 million contractual settlement charge determined in

accordance with Emerging Issues Task Force (“EITF”) Issue 04-1, Accounting for Preexisting Relationships

between the Parties to a Business Combination, plus approximately $0.1 million in acquisition costs. Approx-

imately $16.2 million of the acquisition price was paid with cash on hand at the time of closing with the remaining

approximately $0.8 million to be paid with interest within twelve months of the closing date. The Consolidated

56

PANERA BREAD COMPANY

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS — (Continued)