OfficeMax 2007 Annual Report Download - page 96

Download and view the complete annual report

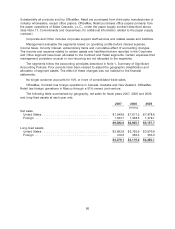

Please find page 96 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(d) Includes $10.9 million of charges related to headquarters consolidation, $9.0 million of income related to favorable

adjustments to facility closure reserves and $9.2 million of income from adjustments to the estimated fair value of the

Additional Consideration Agreement we entered into in connection with the sale of our paper, forest products and

timberland assets in 2004.

(e) Includes $11.4 million of charges related to headquarters consolidation, and $7.9 million of charges related to the

reorganization in our Contract segment.

(f) Includes $7.9 million of charges related to headquarters consolidation, $2.4 million of charges related to the

reorganization in our Contract segment, including international restructuring and asset write-offs, $38.8 million of

income from adjustments to the estimated fair value of the Additional Consideration Agreement we entered into in

connection with the sale of our paper, forest products and timberland assets in 2004, and $3.7 million of income tax

benefits related to the Company’s Elma, Washington manufacturing facility that is accounted for as a discontinued

operation.

(g) Quarters added together may not equal full year amount because each quarter is calculated on a stand-alone basis.

(h) The Company’s common stock (symbol OMX) is traded on the New York Stock Exchange.

92