OfficeMax 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

this obligation resulted in the recognition of non-operating income in our Consolidated Statement of

Income (Loss) of $48.0 million in 2006 and $32.5 million in 2007. Based upon actual and projected

paper prices at December 29, 2007 and December 30, 2006, we did not recognize an asset or

liability in our Consolidated Balance Sheet related to the Additional Consideration Agreement.

In February 2008, Boise Cascade, L.L.C. sold a majority interest in its paper and packaging

and newsprint businesses to Aldabra 2 Acquisition Corp. As a result of this transaction, the

Additional Consideration Agreement terminated and no further payments will be required of either

party.

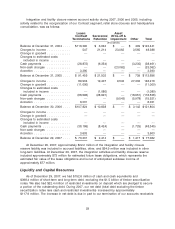

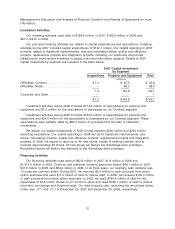

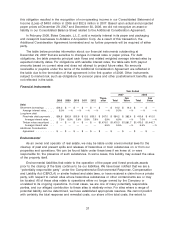

The table below provides information about our financial instruments outstanding at

December 29, 2007 that are sensitive to changes in interest rates or paper prices. For debt

obligations, the table presents principal cash flows and related weighted average interest rates by

expected maturity dates. For obligations with variable interest rates, the table sets forth payout

amounts based on current rates and does not attempt to project future rates. No amounts

receivable or payable under the terms of the Additional Consideration Agreement are reflected in

the table due to the termination of that agreement in the first quarter of 2008. Other instruments

subject to market risk, such as obligations for pension plans and other postretirement benefits, are

not reflected in the table.

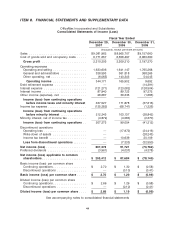

Financial Instruments

Year Ended

2007 2006

There- Fair Fair

2008 2009 2010 2011 2012 after Total Value Total Value

Debt

Short-term borrowings ...... $14.2 $ — $ — $ — $ — $ — $ 14.2 $ 14.2 $ — $ —

Average interest rates ..... 9.0% —% —% —% —% —% 9.0% —% —% —%

Long-term debt

Fixed-rate debt payments . . $34.8 $50.9 $15.9 $ 0.5 $35.1 $ 247.0 $ 384.2 $ 382.4 $ 410.6 $ 412.0

Average interest rates . . . 7.5% 8.9% 5.6% 5.8% 7.9% 5.9% 6.9% —% 7.0% —%

Timber notes securitized . . . $ — $ — $ — $ — $ — $1,470.0 $1,470.0 $1,581.7 $1,470.0 $1,440.7

Average interest rates . . . ————— 5.5% 5.5% —% 5.5% —%

Additional Consideration

Agreement ........... $ — $ — $ — $ — $ — $ — $ — $ — $ — $ —

Environmental

As an owner and operator of real estate, we may be liable under environmental laws for the

cleanup of past and present spills and releases of hazardous or toxic substances on or from our

properties and operations. We can be found liable under these laws if we knew of, or were

responsible for, the presence of such substances. In some cases, this liability may exceed the value

of the property itself.

Environmental liabilities that relate to the operation of the paper and forest products assets

prior to the closing of the Sale continue to be our liabilities. We have been notified that we are a

‘‘potentially responsible party’’ under the Comprehensive Environmental Response, Compensation

and Liability Act (CERCLA) or similar federal and state laws, or have received a claim from a private

party, with respect to certain sites where hazardous substances or other contaminants are or may

be located. All of these sites relate to operations either no longer owned by the Company or

unrelated to its ongoing operations. In most cases, we are one of many potentially responsible

parties, and our alleged contribution to these sites is relatively minor. For sites where a range of

potential liability can be determined, we have established appropriate reserves. We cannot predict

with certainty the total response and remedial costs, our share of the total costs, the extent to

37