OfficeMax 2007 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Timber Notes

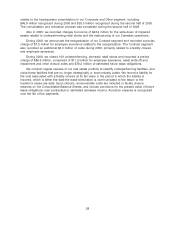

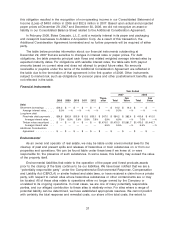

In October 2004, we sold our timberlands as part of the Sale and received credit-enhanced

timber installment notes receivable in the amount of $1,635 million. In December 2004, we

completed a securitization transaction in which our interests in the timber installment notes

receivable and related guarantees were transferred to wholly-owned bankruptcy remote subsidiaries

that were designated to be qualifying special purpose entities (the ‘‘OMXQ’s’’). The OMXQ’s

pledged the timber installment notes receivable and related guarantees and issued securitization

notes in the amount of $1,470 million. Recourse on the securitization notes is limited to the pledged

timber installment notes receivable. The securitization notes are 15-year non-amortizing, and were

issued in two equal $735 million tranches paying interest of 5.42% and 5.54%, respectively.

As a result of these transactions, we received $1,470 million in cash from the OMXQ’s, and

over 15 years will earn approximately $82.5 million per year in interest income on the timber

installment notes receivable and incur annual interest expense of approximately $80.5 million on the

securitization notes. The pledged timber installment notes receivable and nonrecourse securitization

notes will mature in 2020 and 2019, respectively. The securitization notes have an initial term that is

approximately three months shorter than the installment notes. The Company expects to refinance

its ownership of the installment notes in 2019 with a short-term secured borrowing to bridge the

period from initial maturity of the securitization notes to the maturity of the installment notes.

The original entities issuing the credit enhanced timber installment notes are variable-interest

entities (the ‘‘VIE’s’’) under Financial Accounting Standards Board (‘‘FASB’’) Interpretation 46R,

‘‘Consolidation of Variable Interest Entities’’. The OMXQ’s are considered to be the primary

beneficiary, and therefore, the VIE’s are required to be consolidated with the OMXQ’s, which are

also the issuers of the securitization notes. As a result, the accounts of the OMXQ’s have been

consolidated into those of their ultimate parent, OfficeMax. The effect of our consolidation of the

OMXQ’s is that the securitization transaction is treated as a financing, and both the timber notes

receivable and the securitization notes payable are reflected in the Consolidated Balance Sheets.

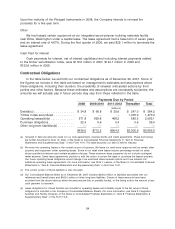

Note Agreements

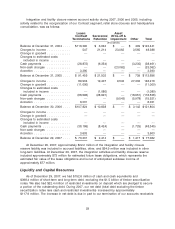

In October 2003, we issued 6.50% senior notes due in 2010 and 7.00% senior notes due in

2013. At the time of issuance, the senior note indentures contained a number of restrictive

covenants, substantially all of which have since been eliminated through the execution of

supplemental indentures as described below. On November 5, 2004, we repurchased substantially

all of the outstanding 6.50% senior notes and received the requisite consents to adopt amendments

to the indenture pursuant to a tender offer for these securities. As a result, the Company and the

trustee executed a supplemental indenture that eliminated substantially all of the restrictive

covenants, certain events of default and related provisions, and replaced them with the covenants

contained in the Company’s other public debt. Those covenants include a limitation on mergers

and similar transactions, a restriction on secured transactions involving Principal Properties, as

defined, and a restriction on sale and leaseback transactions involving Principal Properties.

In December 2004, both Moody’s Investors Service, Inc. and Standard & Poor’s Rating

Services upgraded the credit rating on our 7.00% senior notes to investment grade as a result of

actions we took to collateralize the notes by granting the note holders a security interest in certain

investments maturing in 2008 (the ‘‘Pledged Instruments’’). These pledged instruments are reflected

as restricted investments in the Consolidated Balance Sheets. As a result of these ratings upgrades,

the original 7.00% senior note covenants have been replaced with the covenants found in the

Company’s other public debt. The remaining pledged instruments continue to be subject to the

security interest, and are reflected as restricted investments in the Consolidated Balance Sheets.

33