OfficeMax 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

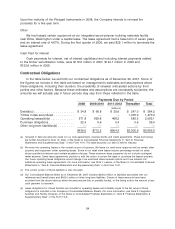

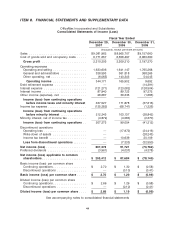

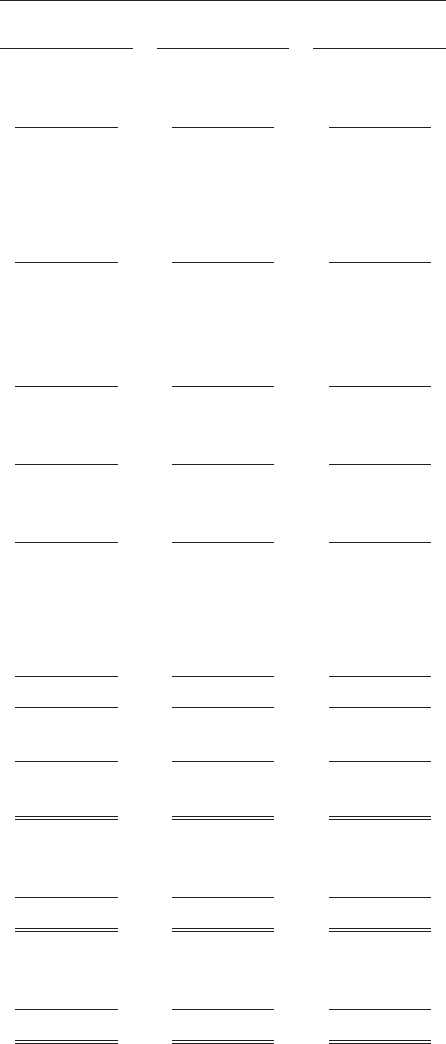

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

OfficeMax Incorporated and Subsidiaries

Consolidated Statements of Income (Loss)

Fiscal Year Ended

December 29, December 30, December 31,

2007 2006 2005

(thousands, except per-share amounts)

Sales ............................... $9,081,962 $ 8,965,707 $ 9,157,660

Cost of goods sold and occupancy costs ..... 6,771,657 6,656,497 6,960,390

Gross profit ........................ 2,310,305 2,309,210 2,197,270

Operating expenses

Operating and selling .................. 1,633,606 1,641,147 1,765,268

General and administrative .............. 338,593 361,818 368,265

Other operating, net ................... (6,065) 140,343 54,045

Operating income .................. 344,171 165,902 9,692

Debt retirement expense ................. — — (14,391)

Interest expense ....................... (121,271) (123,082) (128,504)

Interest income ........................ 87,940 89,723 97,272

Other income (expense), net .............. 26,687 39,335 (1,685)

Income (loss) from continuing operations

before income taxes and minority interest 337,527 171,878 (37,616)

Income tax expense ..................... (125,282) (68,741) (1,226)

Income (loss) from continuing operations

before minority interest .............. 212,245 103,137 (38,842)

Minority interest, net of income tax .......... (4,872) (4,083) (2,370)

Income (loss) from continuing operations . . 207,373 99,054 (41,212)

Discontinued operations

Operating loss ....................... — (17,972) (24,416)

Write-down of assets .................. — — (28,243)

Income tax benefit .................... — 10,639 20,109

Loss from discontinued operations ....... — (7,333) (32,550)

Net income (loss) ...................... 207,373 91,721 (73,762)

Preferred dividends ..................... (3,961) (4,037) (4,378)

Net income (loss) applicable to common

shareholders ........................ $ 203,412 $ 87,684 $ (78,140)

Basic income (loss) per common share

Continuing operations .................. $ 2.70 $ 1.30 $ (0.58)

Discontinued operations ................ — (0.10) (0.41)

Basic income (loss) per common share ..... $ 2.70 $ 1.20 $ (0.99)

Diluted income (loss) per common share

Continuing operations .................. $ 2.66 $ 1.29 $ (0.58)

Discontinued operations ................ — (0.10) (0.41)

Diluted income (loss) per common share .... $ 2.66 $ 1.19 $ (0.99)

See accompanying notes to consolidated financial statements

44