OfficeMax 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations for more

information.

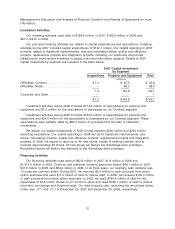

Investment Activities

Our investing activities used cash of $138.9 million in 2007, $163.9 million in 2006 and

$97.3 million in 2005.

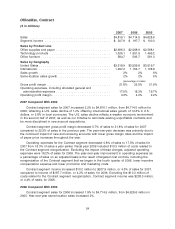

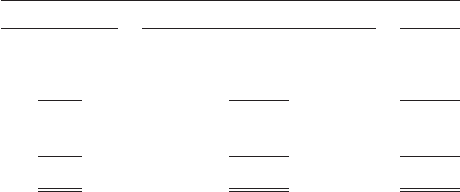

Our principal investing activities are related to capital expenditures and acquisitions. Investing

activities during 2007 included capital expenditures of $142.1 million. Our capital spending in 2007

primarily related to leasehold improvements, new and remodeled stores, quality and efficiency

projects, replacement projects and integration projects, including our previously announced

infrastructure improvement initiatives in supply chain and information systems. Details of 2007

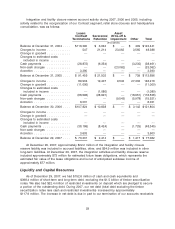

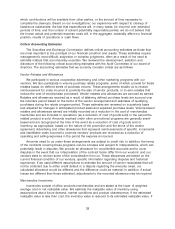

capital investment by segment are included in the table below:

2007 Capital Investment

by Segment

Acquisitions Property and Equipment Total

(millions)

OfficeMax, Contract .................... $1.3 $ 42.5 $ 43.8

OfficeMax, Retail ...................... — 98.3 98.3

1.3 140.8 142.1

Corporate and Other ................... — — —

$ 1.3 $140.8 $142.1

Investment activities during 2006 included $174.8 million of expenditures for property and

equipment and $1.5 million for the acquisitions of businesses by our Contract segment.

Investment activities during 2005 included $152.5 million of expenditures for property and

equipment and $34.8 million for the acquisitions of businesses by our Contract segment. These

expenditures were partially offset by $93.3 million of proceeds from the sale of restricted

investments.

We expect our capital investments in 2008 to total between $200 million and $220 million,

excluding acquisitions. Our capital spending in 2008 will be for leasehold improvements, new

stores, remodeling projects, quality and efficiency projects, replacement projects and integration

projects. In 2008, we expect to open up to 40 new stores, mostly in existing markets, and to

remodel approximately 60 stores. All new stores will feature the Advantage store prototype.

Remodeled stores will feature key elements of the Advantage store prototype.

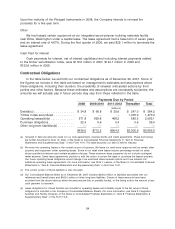

Financing Activities

Our financing activities used cash of $62.6 million in 2007, $1.9 million in 2006 and

$1,015.3 million in 2005. Common and preferred dividend payments totaled $49.1 million in 2007,

$47.6 million in 2006, and $54.2 million in 2005. In all three years, our quarterly cash dividend was

15 cents per common share. During 2007, we received $5.9 million in cash proceeds from stock

option exercises and used $11.6 million of cash to reduce debt. In 2006, we received $130.0 million

in cash proceeds from stock option exercises. In 2005, we used $780.4 million of cash for the

repurchase of 23.5 million shares of our common stock and used $198.7 million of cash to reduce

short-term borrowings and long-term debt. Our debt-to-equity ratio, excluding the securitized timber

notes, was .17:1 and .21:1 at December 29, 2007 and December 30, 2006, respectively.

31