OfficeMax 2007 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for a legal settlement with the Department of Justice related to allegations that the Company

submitted false claims when it sold office supply products manufactured in countries not

permitted by the Trade Agreements Act to U.S. government agencies. We incurred

$14.4 million of costs related to our early retirement of debt, and recorded a $28.2 million

pre-tax charge for the write-down of impaired assets at our Elma, Washington manufacturing

facility, which is accounted for as a discontinued operation.

We evaluate our results of operations both before and after certain gains and losses that

management believes are not indicative of our core operating activities, such as the items

described above. We believe our presentation of financial measures before, or excluding, these

items, which are non-GAAP measures, enhances our investors’ overall understanding of the impact

of the Company’s restructuring activities and our recurring operational performance and provides

useful information to both investors and management to evaluate the ongoing operations and

prospects of the Company by providing better comparisons and information regarding significant

trends and variability in our earnings. Whenever we use non-GAAP financial measures, we

designate those measures as ‘‘adjusted’’ and provide a reconciliation of non-GAAP financial

measures to the most closely applicable GAAP financial measure. Investors are encouraged to

review the related GAAP financial measures and the reconciliation of those non-GAAP financial

measures to their most directly comparable GAAP financial measure.

Although we believe the non-GAAP financial measures enhance an investors’ understanding of

our performance, our management does not itself, nor does it suggest that investors should,

consider such non-GAAP financial measures in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP. The non-GAAP financial measures we use may not

be consistent with the presentation of similar companies in our industry. However, we present such

non-GAAP financial measures in reporting our financial results to provide investors with an

additional tool to evaluate our operating results in a manner that focuses on what we believe to be

our ongoing business operations. In addition, use of the non-GAAP measures that exclude certain

gains and losses is not intended to suggest that our future financial results will not be impacted by

additional unusual items.

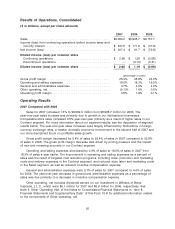

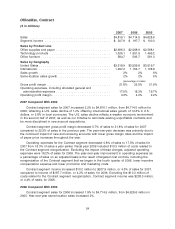

The following table summarizes the impact of the gains and losses described above on our

results of operations for 2007, 2006 and 2005, and provides a reconciliation of our non-GAAP

measures to the corresponding GAAP measure. Both GAAP and non-GAAP measures are used

throughout this Management’s Discussion and Analysis.

18