OfficeMax 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Upon the maturity of the Pledged Instruments in 2008, the Company intends to reinvest the

proceeds for a five year term.

Other

We had leased certain equipment at our integrated wood-polymer building materials facility

near Elma, Washington under a capital lease. The lease agreement had a base term of seven years

and an interest rate of 4.67%. During the first quarter of 2006, we paid $29.1 million to terminate the

lease agreement.

Cash Paid for Interest

Cash payments for interest, net of interest capitalized and including interest payments related

to the timber securitization notes, were $116.6 million in 2007, $124.1 million in 2006 and

$122.6 million in 2005.

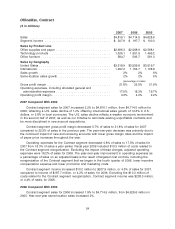

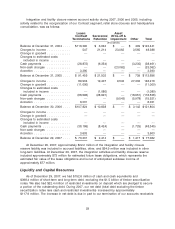

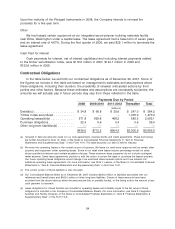

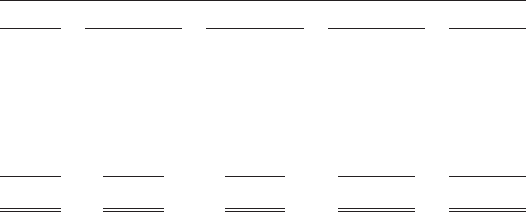

Contractual Obligations

In the table below, we set forth our contractual obligations as of December 29, 2007. Some of

the figures we include in this table are based on management’s estimates and assumptions about

these obligations, including their duration, the possibility of renewal, anticipated actions by third

parties and other factors. Because these estimates and assumptions are necessarily subjective, the

amounts we will actually pay in future periods may vary from those reflected in the table.

Payments Due by Period

2008 2009-2010 2011-2012 Thereafter Total

(millions)

Debt(a)(c) ...................... $ 34.8 $ 66.8 $ 35.6 $ 247.0 $ 384.2

Timber notes securitized ........... — — — 1,470.0 1,470.0

Operating leases(b)(e) ............. 371.8 639.8 468.2 583.3 2,063.1

Purchase obligations .............. 32.4 5.6 0.4 0.6 39.0

Other long-term liabilities(d) ......... — — — — —

$439.0 $712.2 $504.2 $2,300.9 $3,956.3

(a) Included in debt are amounts owed on our note agreements, revenue bonds and credit agreements. These borrowings

are further described in Note 12, Debt, of the Notes to Consolidated Financial Statements in ‘‘Item 8. Financial

Statements and Supplementary Data’’ in this Form 10-K. The table assumes our debt is held to maturity.

(b) We enter into operating leases in the normal course of business. We lease our retail store space as well as certain other

property and equipment under operating leases. Some of our retail store leases require percentage rentals on sales

above specified minimums and contain escalation clauses. These minimum lease payments do not include contingent

rental expense. Some lease agreements provide us with the option to renew the lease or purchase the leased property.

Our future operating lease obligations would change if we exercised these renewal options and if we entered into

additional operating lease agreements. For more information, see Note 7, Leases, of the Notes to Consolidated Financial

Statements in ‘‘Item 8. Financial Statements and Supplementary Data’’ in this Form 10-K.

(c) The current portion of these liabilities is also included.

(d) Our Consolidated Balance Sheet as of December 29, 2007 includes $200.3 million of liabilities associated with our

retirement and benefit plans and $403.0 million of other long-term liabilities. Certain of these amounts have been

excluded from the above table as either the amounts are fully or partially funded, or the timing and/or the amount of any

cash payment is uncertain.

(e) Lease obligations for closed facilities are included in operating leases and a liability equal to the fair value of these

obligations is included in the Company’s Consolidated Balance Sheets. For more information, see Note 3, Integration

Activities and Facility Closures, of the Notes to Consolidated Financial Statements in ‘‘Item 8. Financial Statements &

Supplementary Data’’ in this Form 10-K.

34