OfficeMax 2007 Annual Report Download - page 34

Download and view the complete annual report

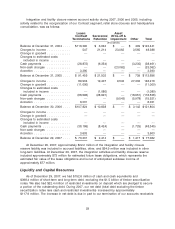

Please find page 34 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.securitization program in 2007. During 2006, we reduced our net debt by approximately

$295 million. Since the end of 2003, we have paid down approximately $1.9 billion of debt, primarily

with proceeds from the Sale, and expensed $151.5 million of costs related to the early retirement of

debt. We have also returned nearly $885 million of cash to equity holders, including the repurchase

of 23.5 million shares of our common stock for $775.5 million, plus transaction costs in 2005. Our

ratio of current assets to current liabilities was 1.61:1 at December 29, 2007, compared with 1.37:1

at December 30, 2006. The increase in our ratio of current assets to current liabilities at

December 29, 2007 resulted primarily from a decrease in accounts payable and an increase in

accounts receivable as a result of the termination of our securitization program on July 12, 2007,

with the simultaneous restructuring of our revolving credit facility.

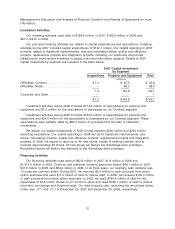

Our primary ongoing cash requirements relate to working capital, expenditures for property and

equipment, lease obligations and debt service. We expect to fund these requirements through a

combination of cash flow from operations and seasonal borrowings under our revolving credit

facility. The sections that follow discuss in more detail our operating, investing, and financing

activities, as well as our financing arrangements.

Operating Activities

Our operating activities generated cash of $70.6 million and $375.6 million in 2007 and 2006,

respectively, and used cash of $56.9 million in 2005. In 2007, items included in net income

provided $378.0 million of cash, and changes in working capital items used $307.4 million. Cash

used by working capital changes includes the effect of terminating our accounts receivable

securitization program and the resulting increase in accounts receivable, and a reduction in

accounts payable-to-inventory leverage due to decreased inventory turnover and reduced terms for

a few key vendors. These changes were partially offset by the monetization of certain Company-

owned life insurance assets. In 2006, items included in net income (loss) provided $270.1 million of

cash, and favorable changes in working capital items provided $105.5 million. Included in net

working capital changes during 2005 were net income tax payments of $134.1 million primarily

related to gains recognized in 2004. Other working capital changes in 2005 included a reduction in

accounts payable and accrued liabilities partially offset by improved accounts receivable and

inventory levels.

On July 12, 2007, we entered into a new loan agreement (See Note 12, Debt of the notes to

Consolidated Financial Statements in ‘‘Item 8, Financial Statements and Supplementary Data’’ of

this Form 10-K). The new loan agreement amended our existing revolving credit facility and

replaced our accounts receivable securitization program. The transferred accounts receivable under

the accounts receivable securitization program at that date were refinanced with borrowings under

the new loan agreement and excess cash which reduced cash provided by operations. We no

longer sell any of our accounts receivable. At December 30, 2006 $180.0 million of sold accounts

receivable were excluded from Receivables in our Consolidated Balance Sheet. Cash flow from

operations in 2006 and 2005 benefited from increases in the amount of receivables sold under this

program by $17 million and $43 million, respectively.

We sponsor noncontributory defined benefit pension plans covering certain terminated

employees, vested employees, retirees, and some active OfficeMax, Contract employees. Pension

expense was $10.0 million, $13.7 million and $21.7 million for the years ended December 29, 2007,

December 30, 2006 and December 31, 2005, respectively. In 2007, 2006 and 2005, we made

contributions to our pension plans totaling $19.1 million, $9.6 million and $2.8 million, respectively.

Since our active employees who are covered by the plans, as well as all of the inactive participants,

are no longer accruing additional benefits, we do not expect our future contributions to these plans

to be significant. The minimum required contribution in 2008 is approximately $9.4 million. However,

we may elect to make additional voluntary contributions. See ‘‘Critical Accounting Estimates’’ in this

30