OfficeMax 2007 Annual Report Download - page 39

Download and view the complete annual report

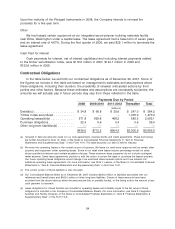

Please find page 39 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In accordance with an amended and restated joint venture agreement, the minority owner of

our subsidiary in Mexico, Grupo OfficeMax, can elect to put its remaining 49% interest in the

subsidiary to OfficeMax if earnings targets are achieved. At December 29, 2007, Grupo OfficeMax

had met these earnings targets, which are calculated quarterly on a rolling four-quarter basis.

Accordingly, the targets can be achieved in one quarter but not in the next. If the earnings targets

are achieved and the minority owner elects to put its ownership interest, the purchase price would

be equal to fair value, calculated based on both the subsidiary’s earnings for the last four quarters

before interest, taxes and depreciation and amortization, and the current market multiples of similar

companies. The fair value purchase price is currently estimated at $65 million to $70 million. This

contingent obligation is not included in the table above.

In addition to the contractual obligations quantified in the table above, we have other

obligations for goods and services entered into in the normal course of business. These contracts,

however, are either not enforceable or legally binding or are subject to change based on our

business decisions.

Off-Balance-Sheet Activities and Guarantees

Prior to July 2007, we sold, on a revolving basis, an undivided interest in a defined pool of

receivables while retaining a subordinated interest in a portion of the receivables. The receivables

were sold without legal recourse to third party conduits through a wholly owned bankruptcy-remote

special purpose entity that was consolidated for financial reporting purposes. We continued

servicing the sold receivables and charged the third party conduits a monthly servicing fee at

market rates. The program qualified for sale treatment under FASB Statement No. 140, ‘‘Accounting

for Transfers and Servicing of Financial Assets and Extinguishment of Liabilities.’’ At December 30,

2006 $180.0 million of sold accounts receivable were excluded from receivables in the

accompanying Consolidated Balance Sheet. Our subordinated retained interest in the transferred

receivables was $111.2 million December 30, 2006 and is included in receivables, net in the

Consolidated Balance Sheet.

On July 12, 2007, we entered into a new loan agreement (See Note 12, Debt, of the notes to

Consolidated Financial Statements in ‘‘Item 8, Financial Statements and Supplementary Data’’ of

this Form 10-K). The new loan agreement amended our existing revolving credit facility and

replaced our accounts receivable securitization program. The transferred accounts receivable under

the accounts receivable securitization program at that date were refinanced with borrowings under

the new loan agreement and excess cash. We no longer sell any of our accounts receivable.

Guarantees

Note 17, Commitments and Guarantees, of the Notes to Consolidated Financial Statements in

‘‘Item 8. Financial Statements and Supplementary Data’’ in this Form 10-K describes the nature of

our guarantees, including the approximate terms of the guarantees, how the guarantees arose, the

events or circumstances that would require us to perform under the guarantees and the maximum

potential undiscounted amounts of future payments we could be required to make.

Inflationary and Seasonal Influences

We believe that neither inflation nor deflation has had a material effect on our financial

condition or results of operations; however, there can be no assurance that we will not be affected

by inflation or deflation in the future.

Our business is seasonal, with OfficeMax, Retail showing a more pronounced seasonal trend

than OfficeMax, Contract. Sales in the second quarter and summer months are historically the

slowest of the year. Sales are stronger during the first, third and fourth quarters that include the

35