OfficeMax 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

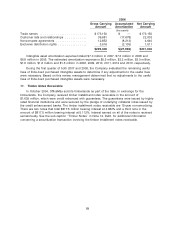

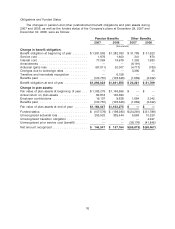

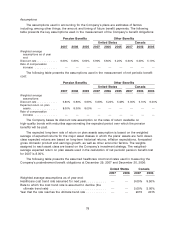

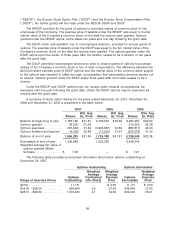

Assumptions

The assumptions used in accounting for the Company’s plans are estimates of factors

including, among other things, the amount and timing of future benefit payments. The following

table presents the key assumptions used in the measurement of the Company’s benefit obligations:

Pension Benefits Other Benefits

United States Canada

2007 2006 2005 2007 2006 2005 2007 2006 2005

Weighted average

assumptions as of year

end:

Discount rate ............ 6.30% 5.80% 5.60% 5.90% 5.60% 5.20% 5.50% 5.00% 5.10%

Rate of compensation

increase ............. —————————

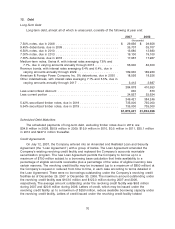

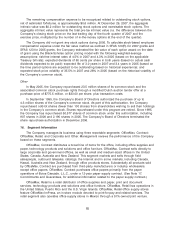

The following table presents the assumptions used in the measurement of net periodic benefit

cost:

Pension Benefits Other Benefits

United States Canada

2007 2006 2005 2007 2006 2005 2007 2006 2005

Weighted average

assumptions:

Discount rate ............ 5.80% 5.60% 5.60% 5.60% 5.20% 5.48% 5.00% 5.10% 6.00%

Expected return on plan

assets ............... 8.00% 8.00% 8.00% ——————

Rate of compensation

increase ............. —————————

The Company bases its discount rate assumption on the rates of return available on

high-quality bonds with maturities approximating the expected period over which the pension

benefits will be paid.

The expected long-term rate of return on plan assets assumption is based on the weighted

average of expected returns for the major asset classes in which the plans’ assets are held. Asset-

class expected returns are based on long-term historical returns, inflation expectations, forecasted

gross domestic product and earnings growth, as well as other economic factors. The weights

assigned to each asset class are based on the Company’s investment strategy. The weighted-

average expected return on plan assets used in the calculation of net periodic pension benefit cost

for 2007 is 8.00%.

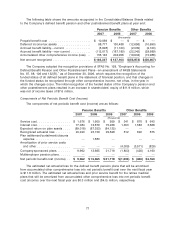

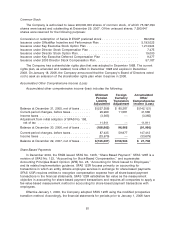

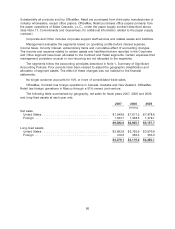

The following table presents the assumed healthcare cost trend rates used in measuring the

Company’s postretirement benefit obligations at December 29, 2007 and December 30, 2006:

United States Canada

2007 2006 2007 2006

Weighted average assumptions as of year-end:

Healthcare cost trend rate assumed for next year ........... — — 9.00% 9.50%

Rate to which the cost trend rate is assumed to decline (the

ultimate trend rate) ............................... — — 5.00% 5.00%

Year that the rate reaches the ultimate trend rate ........... — — 2015 2015

78