OfficeMax 2007 Annual Report Download - page 25

Download and view the complete annual report

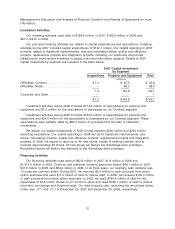

Please find page 25 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In 2006, Other operating, net also included $89.5 million related to the 109 domestic store

closures, $46.4 million primarily related to the headquarters consolidation and $10.3 million

primarily related to the Contract segment reorganization.

Interest expense was $121.3 million in 2007 compared to $123.1 million in 2006. The

year-over-year decrease in interest expense was a result of lower average borrowings. Interest

expense includes interest related to the timber securitization notes of approximately $80.5 million for

2007 and 2006. The interest expense associated with the timber securitization notes is offset by

interest income earned on the timber notes receivable of approximately $82.5 million for both 2007

and 2006. The interest income on the timber notes receivable is included in interest income and is

not netted against the related interest expense in our Consolidated Statements of Income (Loss).

Excluding the interest income earned on the timber notes receivable, interest income was

$5.4 million and $7.2 million for the years ended December 29, 2007 and December 30, 2006,

respectively.

Other income (expense), net was $26.7 million of income in 2007 compared to $39.3 million of

income in 2006. In 2007 and 2006, we recognized income of $32.5 million and $48.0 million,

respectively, in Other income (expense), net related to the Additional Consideration Agreement that

was entered into in connection with the Sale. See Note 13, Financial Instruments, Derivatives and

Hedging Activities, of the Notes to Consolidated Financial Statements in ‘‘Item 8. Financial

Statements and Supplementary Data’’ of this Form 10-K for additional information related to the

Additional Consideration Agreement.

Our effective tax rate attributable to continuing operations was 37.1% in 2007 and 40.0% in

2006. Income taxes for both periods were affected by the impact of state income taxes,

non-deductible expenses and the mix of domestic and foreign sources of income. The effective rate

for 2007 was also impacted by the closure of certain prior year audits, which reduced the effective

rate. In 2006, we increased our valuation allowance for certain state net operating loss

carryforwards by $6.5 million.

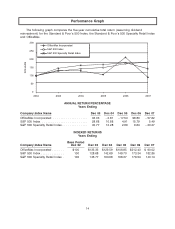

As a result of the foregoing factors, we reported income from continuing operations of

$207.4 million, or $2.66 per diluted share, for 2007, compared to $99.1 million, or $1.29 per diluted

share, for 2006. We reported net income for 2007 of $207.4 million, or $2.66 diluted share

compared with net income of $91.7 million, or $1.19 per diluted share in 2006. Excluding the

charge related to the sale of OfficeMax, Contract’s operations in Mexico and the effect of the

Additional Consideration Agreement, adjusted income from continuing operations was

$188.1 million, or $2.41 per diluted share, for 2007. Excluding the effect of the Additional

Consideration Agreement adjustment, the charges for store closures, contract segment

reorganization and our headquarters consolidation, adjusted income from continuing operations

was $159.1million, or $2.10 per diluted share, for 2006.

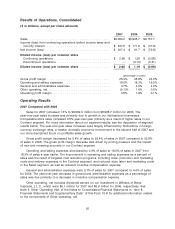

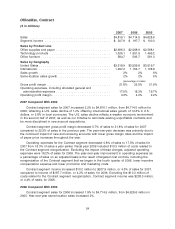

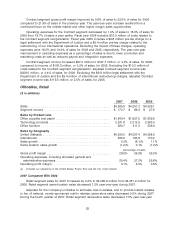

2006 Compared with 2005

Sales for 2006 decreased 2.1% to $8,965.7 million from $9,157.7 million for 2005. The

year-over-year sales decrease was primarily due to the impact of 109 strategic store closings in the

first quarter of 2006 and the 53rd week included in the 2005 Retail segment results. Comparable-

store sales increased 1.0% year-over-year primarily as a result of higher sales in our Contract

segment. For more information about our segment results, see the discussion of segment results

below.

Gross profit margin improved by 1.8% of sales to 25.8% of sales in 2006 compared to 24.0% of

sales in the previous year. The gross profit margin increase was driven by gross margin

improvement initiatives in both the Contract and Retail segments.

21