OfficeMax 2007 Annual Report Download - page 58

Download and view the complete annual report

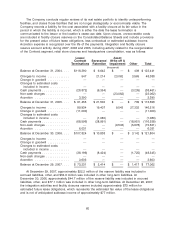

Please find page 58 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.pension and postretirement benefit income or expense is also determined using assumptions which

include expected long-term rates of return on plan assets and discount rates. The Company bases

the discount rate assumption on the rates of return on high-quality bonds currently available and

expected to be available during the period to maturity of the pension benefits. The long-term asset

return assumption is based on the average rate of earnings expected on invested funds, and

considers several factors including actual historical rates, expected rates and external data.

The Company’s policy is to fund its pension plans based upon actuarial recommendations and

in accordance with applicable laws and income tax regulations. Pension benefits are primarily paid

through trusts funded by the Company. All of the Company’s postretirement medical plans are

unfunded. The Company pays postretirement benefits directly to the participants.

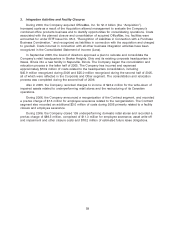

Facility Closure Reserves

The Company conducts regular reviews of its real estate portfolio to identify underperforming

facilities, and closes those facilities that are no longer strategically or economically viable. The

Company accounts for facility closure costs that are not related to a purchase business

combination in accordance with SFAS No. 146, ‘‘Accounting for Costs Associated with Exit or

Disposal Activities.’’ In accordance with SFAS No. 146, the Company records a liability for the cost

associated with a facility closure at its fair value in the period in which the liability is incurred, which

is either the date the lease termination is communicated to the lessor or the location’s cease-use

date. Upon closure, unrecoverable costs are included in facility closure reserves on the

Consolidated Balance Sheets and include provisions for the present value of future lease

obligations, less contractual or estimated sublease income. Accretion expense is recognized over

the life of the payments.

The closure of certain facilities acquired in the OfficeMax, Inc. acquisition was accounted for in

accordance with Emerging Issues Task Force (‘‘EITF’’) Issue No. 95-3, ‘‘Recognition of Liabilities in

Connection With a Purchase Business Combination.’’ The estimated costs to be incurred in closing

these facilities were accrued in connection with the acquisition, and did not result in a charge to

income in the Company’s Consolidated Statements of Income (Loss).

Environmental Matters

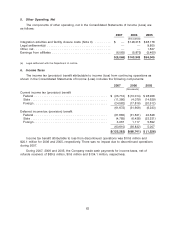

The Company has adopted the provisions of SFAS No. 143, ‘‘Accounting for Asset Retirement

Obligations,’’ in accounting for landfill closure costs related to the sold paper, forest products and

timberland assets. This statement requires legal obligations associated with the retirement of

long-lived assets to be recognized at their fair value at the time the obligations are incurred. Upon

initial recognition of a liability, that cost is capitalized as part of the related long-lived asset and

depreciated on a straight-line basis over the remaining estimated useful life of the asset. The asset

retirement obligation for estimated closure and closed-site monitoring costs recorded on the

Company’s Consolidated Balance Sheet was $4.2 million at December 29, 2007 and December 30,

2006. These obligations are related to assets held for sale.

Environmental liabilities that relate to the operation of the sold paper, forest products and

timberland assets prior to the closing of the Sale transaction were retained by the Company. These

environmental obligations are not within the scope of SFAS No. 143, and the Company accrues for

losses associated with these types of environmental remediation obligations when such losses are

probable and reasonably estimable according to the guidance in SOP 96-1, ‘‘Environmental

Remediation Liabilities.’’ The liabilities for environmental obligations are not discounted to their

present value. (See Note 18, Legal Proceedings and Contingencies, for additional information.)

54