OfficeMax 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

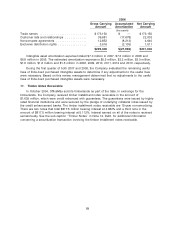

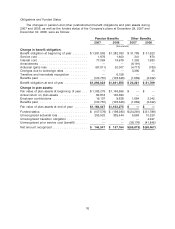

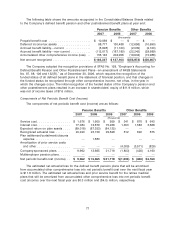

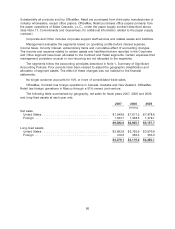

Obligations and Funded Status

The changes in pension and other postretirement benefit obligations and plan assets during

2007 and 2006, as well as the funded status of the Company’s plans at December 29, 2007 and

December 30, 2006, were as follows:

Pension Benefits Other Benefits

2007 2006 2007 2006

(thousands)

Change in benefit obligation:

Benefit obligation at beginning of year ........ $1,381,555 $ 1,382,760 $ 31,789 $ 31,523

Service cost ........................... 1,676 1,600 341 870

Interest cost ........................... 77,084 74,679 1,353 1,583

Amendments .......................... — — (6,191) —

Actuarial (gain) loss ..................... (67,511) 20,007 (4,717) (180)

Changes due to exchange rates ............ — — 3,390 35

Transfers and immediate recognition ......... — 6,158 — —

Benefits paid .......................... (100,781) (103,649) (1,684) (2,042)

Benefit obligation at end of year ............ $1,292,023 $1,381,555 $ 24,281 $ 31,789

Change in plan assets:

Fair value of plan assets at beginning of year . . . $ 1,183,275 $ 1,146,596 $ — $ —

Actual return on plan assets ............... 82,816 130,690 — —

Employer contributions ................... 19,137 9,638 1,684 2,042

Benefits paid .......................... (100,781) (103,649) (1,684) (2,042)

Fair value of plan assets at end of year ....... $1,184,447 $1,183,275 $ — $ —

Funded status ......................... $ (107,576) $ (198,280) $ (24,281) $ (31,789)

Unrecognized actuarial loss ................ 253,923 335,444 5,584 10,220

Unrecognized transition obligation ........... — — — 4,947

Unrecognized prior service cost (benefit) ...... — — (38,176) (41,845)

Net amount recognized ................... $ 146,347 $ 137,164 $(56,873) $(58,467)

76