OfficeMax 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

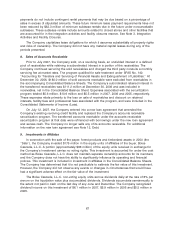

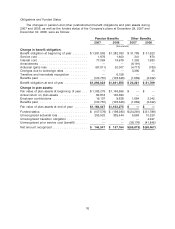

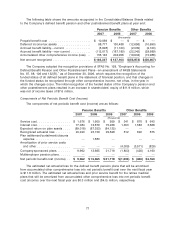

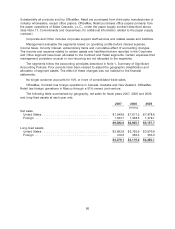

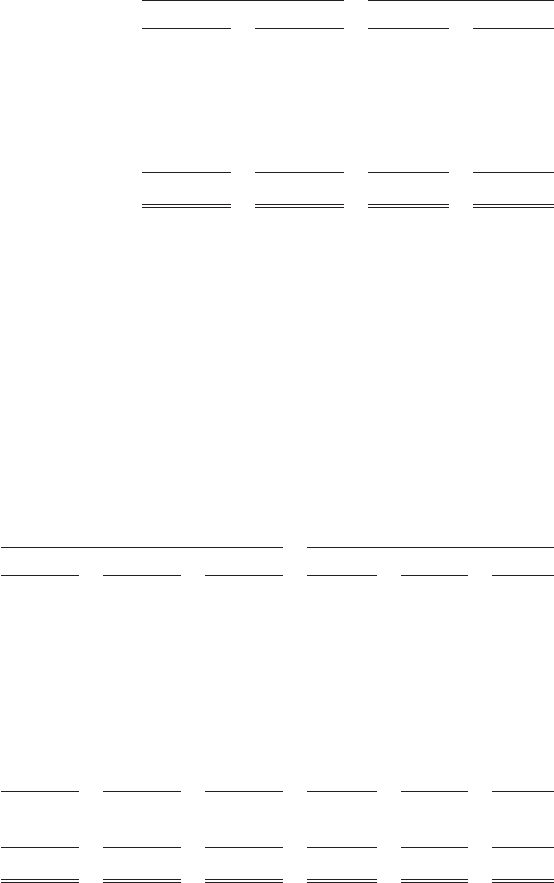

The following table shows the amounts recognized in the Consolidated Balance Sheets related

to the Company’s defined benefit pension and other postretirement benefit plans at year end:

Pension Benefits Other Benefits

2007 2006 2007 2006

(thousands)

Prepaid benefit cost ....................... $ 10,069 $ — $ — $ —

Deferred income tax assets .................. 98,777 130,488 (12,658) (10,690)

Accrued benefit liability—current .............. (5,628) (11,100) (2,039) (2,100)

Accrued benefit liability—non-current ........... (112,017) (187,180) (22,242) (29,689)

Accumulated other comprehensive income (loss) . . 155,146 204,956 (19,934) (15,988)

Net amount recognized ..................... $ 146,347 $ 137,164 $(56,873) $(58,467)

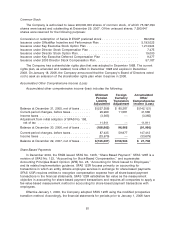

The Company adopted the recognition provisions of SFAS No. 158, ‘‘Employer’s Accounting for

Defined Benefit Pension and Other Postretirement Plans—an amendment of FASB Statements

No. 87, 88, 106 and 132(R),’’ as of December 30, 2006, which requires the recognition of the

funded status of all defined benefit plans in the statement of financial position, and that changes in

the funded status be recognized through other comprehensive income, net of tax, in the year in

which the changes occur. The initial recognition of the funded status of the Company’s pension and

other postretirement plans resulted in an increase in shareholders’ equity of $11.9 million, which

was net of income taxes of $7.6 million.

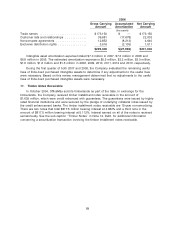

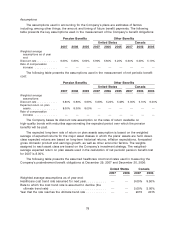

Components of Net Periodic Benefit Cost (Income)

The components of net periodic benefit cost (income) are as follows:

Pension Benefits Other Benefits

2007 2006 2005 2007 2006 2005

(thousands)

Service cost .................. $ 1,676 $ 1,600 $ 959 $ 341 $ 870 $ 643

Interest cost .................. 77,084 74,679 75,266 1,353 1,583 3,668

Expected return on plan assets .... (89,018) (87,353) (84,135) — — —

Recognized actuarial loss ........ 20,220 23,159 29,628 512 692 675

Plan settlement/curtailment/closures

expense ................... — 1,580 — — —

Amortization of prior service costs

and other ..................———(4,009) (3,571) (826)

Company-sponsored plans ....... 9,962 13,665 21,718 (1,803) (426) 4,160

Multiemployer pension plans ......——————

Net periodic benefit cost (income) . . $ 9,962 $ 13,665 $ 21,718 $(1,803) $ (426) $4,160

The estimated net actuarial loss for the defined benefit pension plans that will be amortized

from accumulated other comprehensive loss into net periodic benefit cost over the next fiscal year

is $11.8 million. The estimated net actuarial loss and prior service benefit for the retiree medical

plans that will be amortized from accumulated other comprehensive loss into net periodic benefit

cost (income) over the next fiscal year are $0.3 million and ($4.0) million, respectively.

77