OfficeMax 2007 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

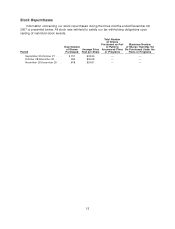

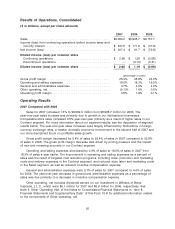

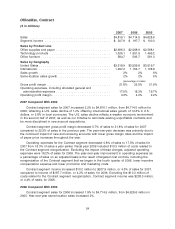

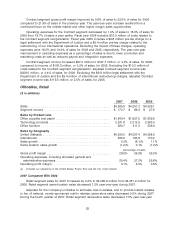

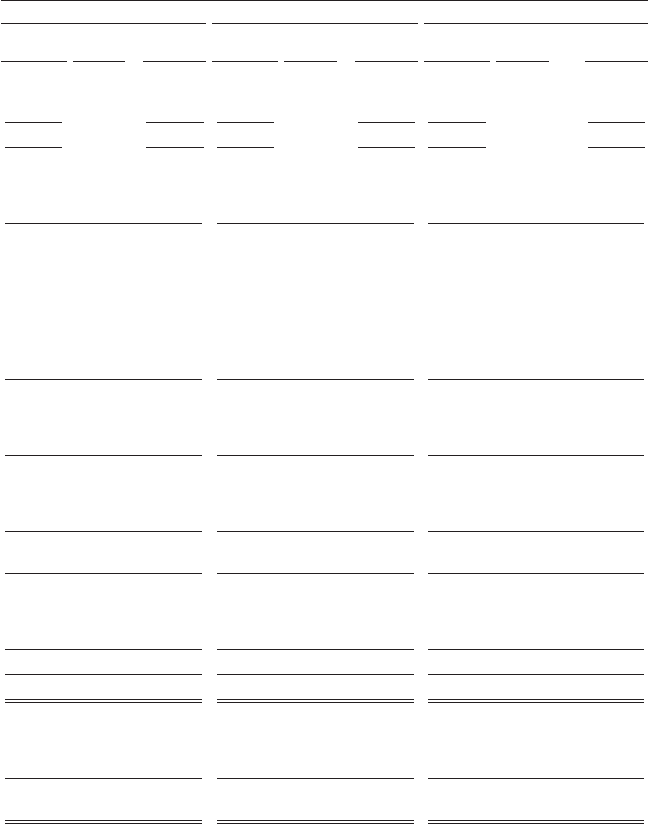

Year Ended (millions, except per-share amounts)

December 29, 2007 December 30, 2006 December 31, 2005

As Special As As Special As As Special As

Reported Items Adjusted Reported Items Adjusted Reported Items Adjusted

Segment Sales

OfficeMax, Contract ........... $4,816.1 $4,816.1 $4,714.5 $4,714.5 $4,628.6 $4,628.6

OfficeMax, Retail ............. 4,265.9 4,265.9 4,251.2 4,251.2 4,529.1 4,529.1

9,082.0 9,082.0 8,965.7 8,965.7 9,157.7 9,157.7

Segment Income (loss)

Office, Contract .............. $ 207.9 $ — $ 207.9 $ 197.7 $ 10.3(a) $ 208.0 $ 100.3 $15.2(a),(i) $ 115.5

OfficeMax, Retail ............. 173.7 — 173.7 86.3 89.5(b) 175.8 27.9 17.9(h) 45.8

Corporate and Other .......... (37.4) — (37.4) (118.0) 46.4(c) (71.6) (118.5) 56.9(c),(j) (61.6)

Operating income (loss) ........ 344.2 — 344.2 166.0 146.2 312.2 9.7 90.0 99.7

Operating Income margin

OfficeMax, Contract ........... 4.3% — 4.3% 4.2% 0.2% 4.4% 2.2% 0.3% 2.5%

OfficeMax, Retail ............. 4.1% — 4.1% 2.0% 2.1% 4.1% 0.6% 0.4% 1.0%

Consolidated ............... 3.8% — 3.8% 1.9% 1.6% 3.5% 0.1% 1.0% 1.1%

Debt retirement expenses ....... — — — — — — (14.4) 14.4(k) —

Interest expense ............. (121.3) — (121.3) (123.1) — (123.1) (128.5) — (128.5)

Interest income and other ....... 114.6 (32.4)(d) 82.2 129.1 (48.0)(d) 81.1 95.6 1.6 97.2

Income (loss) from continuing

operations before income taxes

and minority interest ........ 337.5 (32.4) 305.1 172.0 98.2 270.2 (37.6) 106.0 68.4

Income taxes ............... (125.2) 12.0(g) (113.2) (68.8) (38.2)(g) (107.0) (1.2) (41.2)(g) (42.4)

Income (loss) from continuing

operations before minority

interest ................. 212.3 (20.4) 191.9 103.2 60.0 163.2 (38.8) 64.8 26.0

Minority interest, net of income tax . . (4.9) 1.1(e) (3.8) (4.1) — (4.1) (2.4) — (2.4)

Income (loss) from continuing

operations ............... 207.4 (19.3) 188.1 99.1 60.0 159.1 (41.2) 64.8 23.6

Discontinued operations

Operating loss ............. — — — (18.0) 18.0(f) — (24.4) 24.4(f) —

Write-down of assets ......... — — — — — — (28.2) 28.2(f) —

Income tax benefit .......... — — — 10.6 (10.6)(g) — 20.1 (20.1)(g) —

Loss from discontinued operations . — — — (7.4) 7.4 — (32.5) 32.5 —

Net income (loss) ............ $ 207.4 $(19.3) $ 188.1 $ 91.7 $ 67.4 $ 159.1 $ (73.7) $97.3 $ 23.6

Diluted income (loss) per common

share

Continuing operations ........ $ 2.66 $(0.25) $ 2.41 $ 1.29 $ 0.81 $ 2.10 $ (0.58) $0.82 $ 0.24

Discontinued operations ....... — — — (0.10) 0.10 — (0.41) 0.41 —

Diluted income (loss) per common

share .................. $ 2.66 $(0.25) $ 2.41 $ 1.19 $ 0.91 $ 2.10 $ (0.99) $1.23 $ 0.24

Totals may not foot due to rounding.

(a) Charges associated with the reorganization of our Contract segment included in Contract segment operating expenses.

(b) Charges associated with the closing of 109 retail stores included in Retail segment operating expenses.

(c) Charges associated with the consolidation of our corporate headquarters included in Corporate and Other segment operating

expenses.

(d) Income related to the Additional Consideration agreement included in interest income and other.

(e) Loss from a sale of OfficeMax, Contract’s operations in Mexico included in minority interest, net of income tax.

(f) Loss from Discontinued operations related to a manufacturing facility near Elma, Washington.

(g) Income tax effect of special items.

(h) Charges associated with impaired assets in underperforming retail stores included in Retail segment operating expenses.

(i) Charges associated with a legal settlement with the Department of Justice included in Contract segment operating expenses.

(j) Charges associated with one-time severance payments, professional fees and asset write-downs.

(k) Loss from early retirement of debt.

19