OfficeMax 2007 Annual Report Download - page 26

Download and view the complete annual report

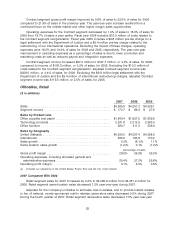

Please find page 26 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Operating and selling expenses decreased by 1.0% of sales to 18.3% of sales in 2006 from

19.3% of sales a year earlier. The improvement in operating and selling expenses as a percent of

sales was the result of targeted cost reduction programs, including lower promotion and marketing

costs, payroll and integration expenses in the Contract segment, and reduced store labor and

marketing costs in the Retail segment.

General and administrative expenses were 4.0% of sales for 2006 and 2005. General and

administrative expenses in 2005 included $24.2 million of expenses for one-time severance

payments and other expenses, primarily professional service fees, which are not expected to be

ongoing. Excluding the severance and other expenses, adjusted general and administrative

expenses were 3.6% of sales for 2005. The year-over-year increase in general and administrative

expenses, excluding the severance and other expenses, was due to increased payroll costs,

primarily increased incentive compensation expense.

In 2006, we reported $140.3 million of expense in Other operating, net which included

$89.5 million related to the 109 domestic store closures, $46.4 million primarily related to the

headquarters consolidation and $10.3 million primarily related to the Contract segment

reorganization. In 2005, we reported $54.0 million of expense in Other operating, net. Other

operating, net for 2005 included a $9.8 million charge for a legal settlement with the Department of

Justice and $25.0 million related to the corporate headquarters consolidation. 2005 also included

$23.2 million of expenses for the write-down of impaired assets at underperforming retail stores and

the restructuring of our Canadian operations. Other operating, net also includes dividends earned

on our investment in affiliates of Boise Cascade, L.L.C., which were $5.9 million for 2006 and

$5.5 million for 2005, respectively. See Note 5, Other Operating, Net, of the Notes to Consolidated

Financial Statements in ‘‘Item 8. Financial Statements and Supplementary Data’’ of this Form 10-K

for additional information related to the components of Other operating, net.

During 2005, we incurred costs related to the early retirement of debt of approximately

$14.4 million primarily as a result of purchasing and cancelling $87.3 million of 7% senior notes

originally due in 2013.

Interest expense was $123.1 million in 2006 compared to $128.5 million in 2005. The

year-over-year decrease in interest expense was a result of lower average borrowings. Interest

expense included interest related to the timber securitization notes of approximately $80.5 million

for 2006 and 2005. The interest expense associated with the timber securitization notes is offset by

interest income earned on the timber notes receivable of approximately $82.5 million for both 2006

and 2005. The interest income on the timber notes receivable is included in interest income and is

not netted against the related interest expense in our Consolidated Statements of Income (Loss).

Excluding the interest income earned on the timber notes receivable, interest income was

$7.2 million and $14.8 million for the years ended December 30, 2006 and December 31, 2005,

respectively. The additional interest income in 2005 included interest earned on the cash and

short-term investments we held following the Sale. Approximately $800 million of the Sale proceeds

were used to repurchase 23.5 million shares of our common stock during the second quarter of

2005.

Other income (expense), net was $39.3 million of income in 2006 compared to $1.7 million of

expense in 2005. In 2006, we reduced the liability related to the Additional Consideration

Agreement that was entered into in connection with the Sale. The reduction in the liability reflected

the effect of changes in our expectations regarding paper prices over the remaining term of the

agreement, and resulted in the recognition of $48.0 million of other non-operating income in 2006.

See Note 13, Financial Instruments, Derivatives and Hedging Activities, of the Notes to Consolidated

Financial Statements in ‘‘Item 8. Financial Statements and Supplementary Data’’ of the Form 10-K

for additional information related to the Additional Consideration Agreement.

22