OfficeMax 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

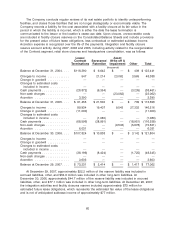

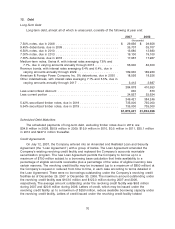

10. Goodwill and Intangible Assets

Goodwill

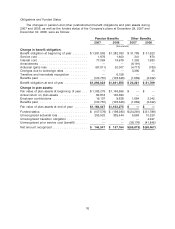

Changes in the carrying amount of goodwill by segment are as follows:

OfficeMax, OfficeMax,

Contract Retail Total

Balance at December 31, 2005 .................... $523,537 $ 694,663 $ 1,218,200

Effect of foreign currency translation ................ 6,423 — 6,423

Businesses acquired ............................ 1,114 — 1,114

Purchase accounting adjustments .................. (2,984) (6,721) (9,705)

Balance at December 30, 2006 .................... 528,090 687,942 1,216,032

Effect of foreign currency translation ................ 28,032 — 28,032

Businesses acquired ............................ 763 — 763

Purchase accounting adjustments .................. — (28,023) (28,023)

Balance at December 29, 2007 .................... $556,885 $659,919 $1,216,804

During 2007, adjustments were necessary to reflect the reversal of income tax reserves that

were recorded in purchase accounting. For additional information on the tax reserve adjustment see

Note 6, Income Taxes. During 2006, adjustments were necessary to reflect the recognition of certain

identifiable assets acquired in a 2005 transaction in the contract segment and the reversal of a

portion of the EITF 95-3 liability recorded in purchase accounting related to the retail segment.

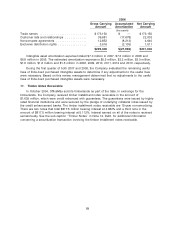

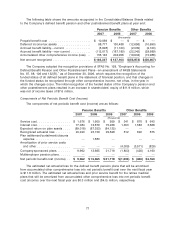

Acquired Intangible Assets

Intangible assets represent the values assigned to trade names, customer lists and

relationships, noncompete agreements and exclusive distribution rights of businesses acquired. The

trade name assets have an indefinite life and are not amortized. All other intangible assets are

amortized on a straight-line basis over their expected useful lives. Customer lists and relationships

are amortized over three to 20 years, noncompete agreements over their terms, which are generally

three to five years, and exclusive distribution rights over ten years. Intangible assets consisted of

the following at year end:

2007

Gross Carrying Accumulated Net Carrying

Amount Amortization Amount

(thousands)

Trade names .......................... $173,150 $ — $ 173,150

Customer lists and relationships ............ 43,381 (23,072) 20,309

Noncompete agreements ................. 12,884 (10,842) 2,042

Exclusive distribution rights ................ 6,977 (2,758) 4,219

$236,392 $(36,672) $199,720

68