OfficeMax 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

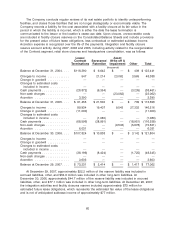

The Company conducts regular reviews of its real estate portfolio to identify underperforming

facilities, and closes those facilities that are no longer strategically or economically viable. The

Company records a liability for the cost associated with a facility closure at its fair value in the

period in which the liability is incurred, which is either the date the lease termination is

communicated to the lessor or the location’s cease-use date. Upon closure, unrecoverable costs

are included in facility closure reserves on the Consolidated Balance Sheets and include provisions

for the present value of future lease obligations, less contractual or estimated sublease income.

Accretion expense is recognized over the life of the payments. Integration and facility closure

reserve account activity during 2007, 2006 and 2005, including activity related to the reorganization

of the Contract segment, retail store closures and headquarters consolidation, was as follows:

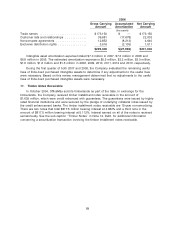

Lease\ Asset

Contract Severance\ Write-off &

Terminations Retention Impairment Other Total

(thousands)

Balance at December 31, 2004 .... $116,390 $ 6,642 $ — $ 409 $ 123,441

Charges to income ............ 547 21,214 23,062 3,565 48,388

Change in goodwill ............ — — — — —

Changes to estimated costs

included in income ........... — — — — —

Cash payments ............... (28,872) (6,354) — (3,235) (38,461)

Non-cash charges ............. — — (23,062) — (23,062)

Accretion ................... 3,390 — — — 3,390

Balance at December 31, 2005 .... $ 91,455 $ 21,502 $ — $ 739 $ 113,696

Charges to income ............ 89,934 19,407 9,543 27,332 146,216

Change in goodwill ............ (11,000) — — — (11,000)

Changes to estimated costs

included in income ........... — (1,080) — — (1,080)

Cash payments ............... (68,596) (28,991) — (18,951) (116,538)

Non-cash charges ............. — — (9,543) (5,978) (15,521)

Accretion ................... 6,031 — — — 6,031

Balance at December 30, 2006 .... $107,824 $ 10,838 $ — $ 3,142 $ 121,804

Charges to income ............ — — — — —

Change in goodwill ............ — — — — —

Changes to estimated costs

included in income ........... — — — — —

Cash payments ............... (38,196) (8,424) — (1,725) (48,345)

Non-cash charges ............. — — — — —

Accretion ................... 3,603 — — — 3,603

Balance at December 29, 2007 .... $ 73,231 $ 2,414 $ — $ 1,417 $ 77,062

At December 29, 2007, approximately $22.2 million of the reserve liability was included in

accrued liabilities, other, and $54.9 million was included in other long-term liabilities. At

December 30, 2006, approximately $44.7 million of the reserve liability was included in accrued

liabilities, other, and $77.1 million was included in other long-term liabilities. At December 29, 2007,

the integration activities and facility closures reserve included approximately $73 million for

estimated future lease obligations, which represents the estimated fair value of the lease obligations

and is net of anticipated sublease income of approximately $77 million.

60