OfficeMax 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 OfficeMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.due to weakness in consumer and small business spending and the Company’s reduced

promotional activity during the holiday season. The fourth quarter same-store sales decrease offset

same store sales increases realized during the first three quarters of 2007. During 2007, we opened

59 new retail stores in the U.S., ending the period with 908 retail stores in the U.S. Our majority

owned joint-venture in Mexico opened 15 stores during 2007, ending the year with 68 stores.

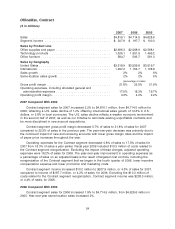

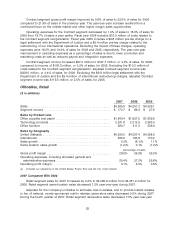

Retail segment gross profit margin improved 0.2% of sales to 29.5% of sales for 2007,

compared to 29.3% of sales in the previous year. The gross margin improvement was primarily due

to the segment’s improved promotional and advertising strategies, primarily during the holiday

season, partially offset by occupancy costs for new stores.

Operating expenses for the Retail segment decreased 1.9% of sales to 25.4% of sales for 2007

from 27.3% of sales a year earlier. During 2006, the Retail segment incurred pre-tax charges of

$89.5 million related to the closure of 109 underperforming retail stores. Excluding the impact of

these charges, adjusted Retail segment operating expenses were 25.2% of sales for 2006. The

year-over-year increase on an as adjusted basis was primarily due to expense deleveraging from

new store openings and the same-store sales decrease, partially offset by reduced incentive

compensation expense.

Retail segment operating income was $173.7 million, or 4.1% of sales, for 2007 and

$86.3 million, or 2.0% of sales, for 2006. Excluding the impact of the store closing related charges,

adjusted Retail segment operating income was $175.8 million, or 4.1% of sales for 2006.

2006 Compared With 2005

Retail segment sales for 2006 decreased 6.1% to $4,251.2 million for 2006 compared to

$4,529.1 million for 2005. Retail segment sales were lower due to the impact of the 109 strategic

store closings during the first quarter of 2006 and the 53rd week included in 2005 results. Retail

segment same-location sales increased 0.1% year-over-year during 2006. During 2006, we opened

44 new retail stores in the U.S., ending the period with 859 retail stores in the U.S. Our majority

owned joint-venture in Mexico opened 12 stores during 2006, ending the year with 55 stores.

Retail segment gross profit margin improved by 3.1% of sales to 29.3% of sales for 2006, from

26.2% of sales in the previous year. The gross margin improvement was primarily due to the

segment’s improved promotional and advertising strategies and reduced inventory shrinkage and

inventory clearance, year-over-year.

Retail segment operating expenses increased by 1.7% of sales to 27.3% of sales for 2006

compared to 25.6% of sales a year earlier. During 2006, the Retail segment incurred pre-tax

charges of $89.5 million related to the closure of 109 underperforming retail stores. In 2005, the

Retail segment incurred asset impairment charges of $17.9 million primarily related to the store

closures. Excluding the impact of these charges, adjusted Retail segment operating expenses were

25.2% of sales for both 2006 and 2005. Operating expenses for 2006 benefited from targeted cost

reductions, including reduced store labor and marketing costs. These improvements were offset by

an increase in allocated general and administrative expenses during 2006.

Retail segment income increased by $58.4 million to $86.3 million, or 2.0% of sales, compared

to income of $27.9 million, or 0.6% of sales, for 2005. Excluding the impact of the store closing

related charges for both years, adjusted Retail segment operating income for 2006 was

$175.8 million, or 4.1% of sales, compared to $45.8 million, or 1.0% of sales for 2005.

Corporate and Other

Corporate and Other expenses were $37.4 million for 2007 compared to $118.0 million for

2006. During 2006, we recorded expenses largely related to the headquarters consolidation in the

26